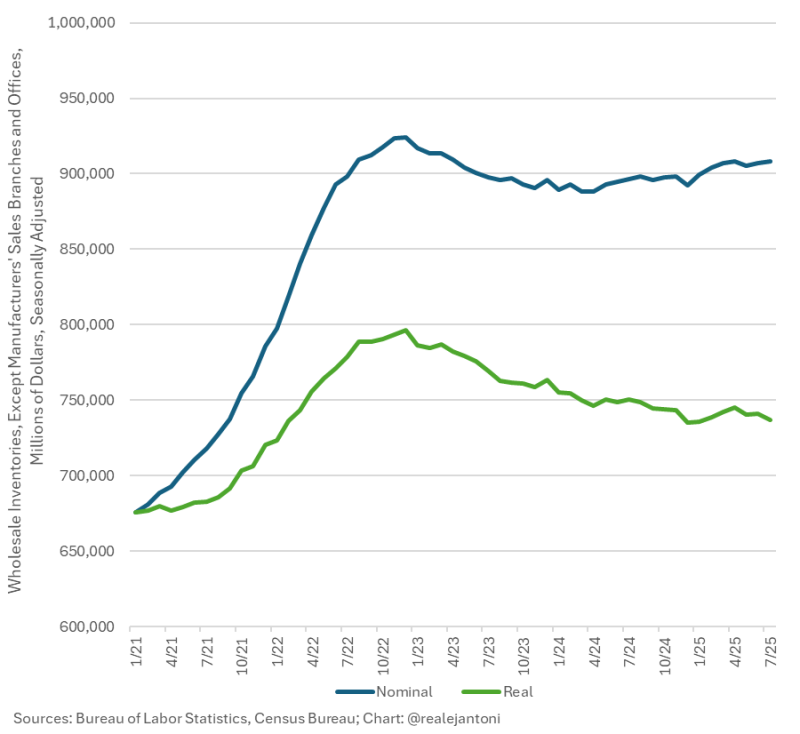

U.S. wholesale inventories tell a misleading story when you look beyond the surface numbers. While reported inventory values have climbed over the past four years, much of that growth comes from higher prices, not from businesses actually holding more goods. When you strip out inflation, a troubling pattern emerges: real inventories have been falling steadily since December 2022, meaning companies are actually holding fewer physical goods even though the dollar values look healthy.

Chart Analysis: When Numbers Diverge

Economist E.J. Antoni, Ph.D. pointed out this disconnect, noting that roughly two-thirds of inventory growth since 2020 was simply the result of price increases, not genuine stockpiling.

The chart shows a growing split between what inventories look like on paper versus what's really on warehouse shelves. Nominal inventories climbed sharply from 2020 through late 2022, painting a picture of strong business stockpiles. But adjust for inflation, and the story flips. Real inventories peaked in late 2022 and have been sliding downward since, showing that businesses are actually running leaner than the headline numbers suggest. Since 2021, inflation has been artificially pumping up the nominal values while the actual volume of goods has contracted.

Why the Decline?

Key factors driving lower real inventories include:

- Inflation pressure inflating reported values without adding real volume

- Softening demand as high costs squeeze consumer spending and slow inventory turnover

- Post-pandemic adjustment after the temporary surge in 2021–22

- Tighter credit conditions as higher interest rates discourage firms from financing large inventories

What This Means for Markets and Policy

Lower real inventories could drag on GDP growth since inventory changes are a component of economic output. Retailers and wholesalers may face earnings pressure as leaner stock levels reflect weaker underlying demand. If restocking continues to slow, supply constraints could resurface and complicate the Federal Reserve's efforts to manage inflation without triggering recession.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah