The U.S. stock market just hit one of its most overvalued points in history. Here's what makes this weird: inflation is still above 3%, wealth inequality is at record levels, and retail investors are jumping into 3x-5x leveraged ETFs. Yet somehow, money is flowing freely. The question everyone should be asking: is this the last hurrah before things fall apart?

What the Buffett Indicator Shows

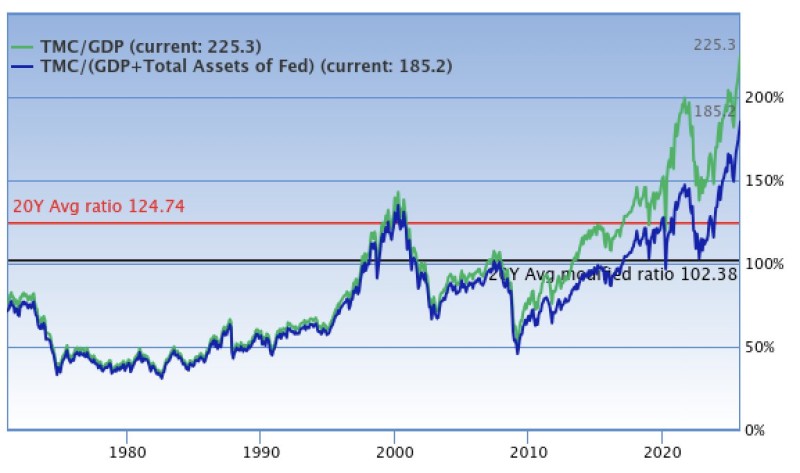

According to a recent chart from Sven Henrich, total market cap has reached 225% of GDP — higher than both the dot-com crash and the 2021 peak. The chart tracks market cap against GDP (often called the Buffett Indicator):

- Current ratio: 225.3% — way above historical norms

- Adjusted for Fed assets (accounting for money printing): still at 185.2%

- 20-year average: 124.74%

- Long-term normal: around 102%

Translation: the stock market is worth more than twice what the actual economy produces. That's only happened during extreme bubble periods.

Looking at the data, three big spikes stand out:

2000 — Dot-com bubble: peaked near 150%, then crashed hard

2021 — Post-COVID stimulus era: briefly topped 200% thanks to massive government spending and zero rates

2025 — Right now: at 225%, even higher than before, and this time the Fed is supposedly tightening

Even when you adjust for the Fed's balance sheet, we're still sitting at 185% — well above where things should be.

The Contradiction Nobody's Talking About

As @NorthmanTrader put it:

"Core inflation above 3%. The wealth gap the widest in our lifetimes. Financial conditions as loose as a wild squirrel. Retail chasing with 3x–5x leverage ETFs. Time to end QT and begin a new easing cycle. The absurdity of it all."

Think about that for a second. Inflation is high, but money is still cheap and flowing everywhere. Credit is easy. Stocks keep climbing. Retail traders are using leverage to juice returns even more. None of this makes sense if you look at the fundamentals.

A few things are colliding at once:

Fed liquidity tricks: Even though "quantitative tightening" is supposedly happening, money keeps finding its way into markets through Treasury operations and other backdoors

AI hype cycle: Big tech stocks are dominating indexes and pushing overall valuations up

Foreign money: Investors around the world see U.S. markets as the safest bet during uncertain times

Retail leverage mania: More people than ever are using leveraged ETFs and options, amplifying every move

Bottom line: stock prices are rising way faster than actual earnings or economic growth. Wall Street and Main Street are living in two different realities.

Usman Salis

Usman Salis

Usman Salis

Usman Salis