⬤ Silver is making serious moves toward the $100 mark after going nearly vertical in recent months. The metal now sits just 25% away from that psychological milestone, grabbing attention from commodity traders and precious metals investors. The sharp acceleration has transformed what was once a steady climb into an aggressive upward surge.

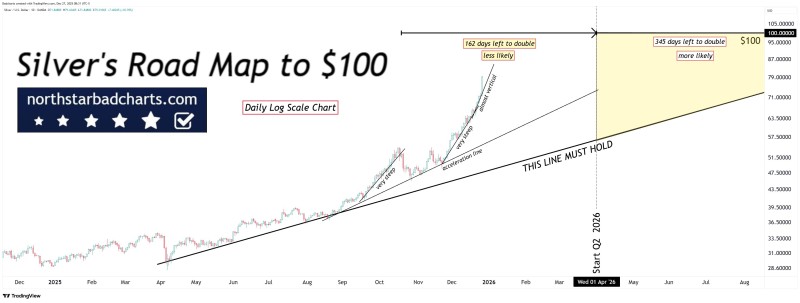

⬤ A long-term chart on a daily logarithmic scale shows where the rally shifted gears from measured gains into a steep, almost vertical advance. One critical rising support line carries the note "THIS LINE MUST HOLD," highlighting its technical importance for the entire structure. The projection area toward $100 includes timeline scenarios—reaching the level quickly appears less likely than a longer journey, though both paths remain within the bullish framework.

⬤ Recent price action reflects just how fast silver has climbed during this acceleration phase. The question now centers on pace and sustainability—whether momentum can push through to $100 without pullbacks, or if consolidation periods might slow the advance.

⬤ This matters because silver functions as both a precious metal and industrial commodity, meaning sharp price swings can ripple through broader market sentiment. With silver closer to the symbolic $100 level than ever before in this cycle, traders will be watching closely to see if momentum holds or the market takes a breather after such a steep run.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets