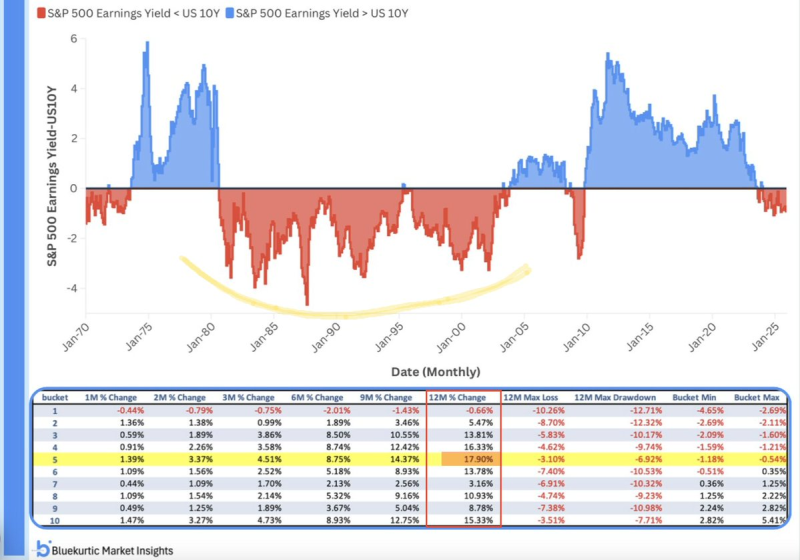

⬤ The S&P 500 equity risk premium has dropped into negative territory at approximately -0.92%, marking a valuation setup that historically preceded strong market performance. This occurs when the index's earnings yield falls below the 10-year Treasury rate, a condition that many investors view as stocks being expensive relative to bonds.

⬤ Historical data reveals that during periods with similar negative risk premiums, the S&P 500 posted average 12-month gains of 17.9%—the strongest performance across all equity risk premium environments studied. The pattern appeared notably during extended stretches in the 1980s and 1990s, when earnings yields remained below Treasury rates while markets climbed higher.

⬤ The equity risk premium serves as a key valuation metric comparing stock earnings power against government bond yields. While a negative reading technically suggests stocks are priced richly versus Treasuries, the historical record shows this condition has coincided with robust forward returns rather than market peaks. Whether today's -0.92% reading will follow past patterns remains the focus for investors watching current market dynamics.

Usman Salis

Usman Salis

Usman Salis

Usman Salis