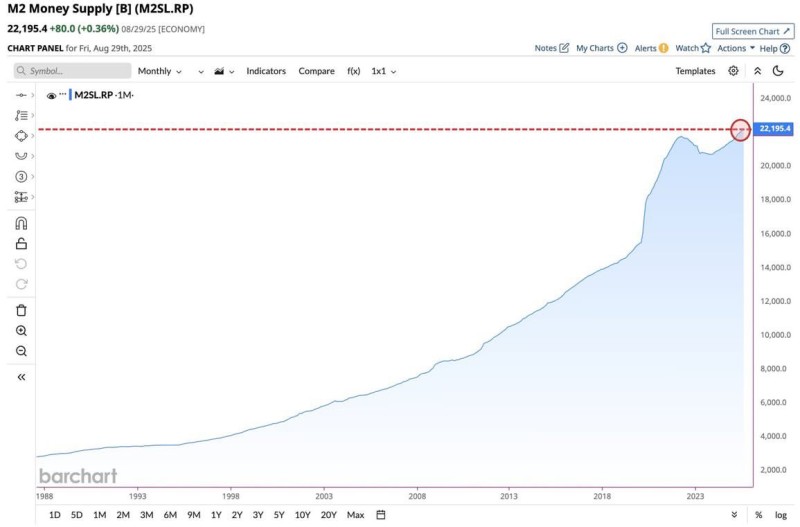

The U.S. money supply has reached an unprecedented $22.2 trillion, highlighting the massive amount of liquidity flowing through our financial system. This isn't just another economic statistic—it's a crucial indicator that helps explain current inflation trends, market behavior, and why keeping your money in cash might be riskier than you think.

Money Supply Reaches New Heights

Financial analyst Andrew Lokenauth | TheFinance recently pointed out that the U.S. M2 money supply has resumed its upward climb, hitting levels we've never seen before. Looking at the long-term data, there's been a steady increase over decades, but things really took off after 2020. That's when pandemic relief programs and Federal Reserve policies injected massive amounts of money into the economy.

After leveling off somewhat in 2022 and 2023, the money supply started growing again, reaching $22.2 trillion by August 2025. This shows that expansionary policies are still very much in play, even as policymakers worry about rising prices.

What This Means for Your Money

When there's more money in circulation, it often leads to higher prices over time—basic supply and demand economics. Here's what investors should consider:

- Keep your money working: Cash sitting in accounts loses buying power when inflation rises

- Focus on limited supply assets: Stocks, real estate, gold, and Bitcoin tend to do well when there's lots of liquidity looking for a home

- Don't hold too much cash: While cash provides stability for short-term needs, it consistently loses value against inflation over time

The data shows us that liquidity growth isn't temporary—it's become a permanent feature of how our economy works. Every time M2 has dropped in recent decades, it eventually resumed growing. The big jump after 2020 and the new highs in 2025 help explain why markets often stay strong even when economic news looks troubling. All that money has to go somewhere, and it usually ends up pushing asset prices higher.

Usman Salis

Usman Salis

Usman Salis

Usman Salis