Financial markets are preparing for what could be a crucial Federal Reserve decision as economic indicators paint a mixed but encouraging picture. With inflation meeting expectations, GDP revisions trending upward, and market participants increasingly betting on monetary policy easing, all eyes are turning toward the Fed's October meeting. Key Federal Reserve officials are scheduled to speak, adding another layer of anticipation to what traders are already calling the beginning of "Uptober" season.

Rate Cut Expectations Reach New Heights

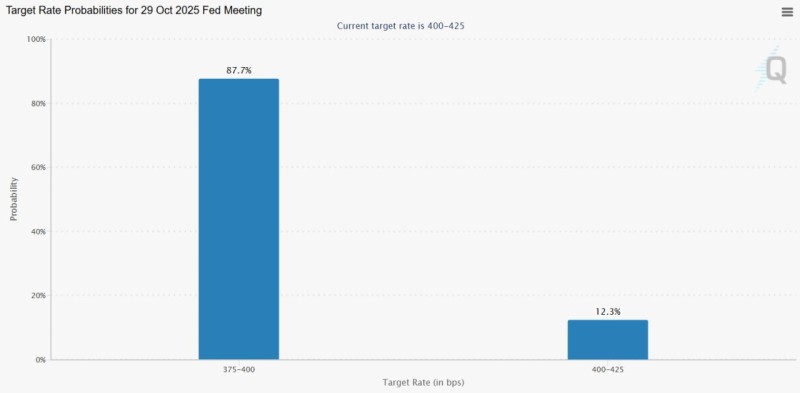

Market sentiment has shifted dramatically in recent weeks. Traders now place an 87.7% probability on the Federal Reserve cutting rates to the 3.75–4.00% range at their October 29 meeting, leaving only 12.3% odds for rates staying at the current 4.00–4.25% level. This represents a significant consolidation of market opinion around the expectation of monetary policy easing.

Recent analysis from Cas Abbé on social media captured this shift perfectly, pointing to steady inflation trends, stronger GDP performance, and climbing rate cut expectations as the key factors driving market positioning. The data suggests investors are increasingly confident the Fed is ready to pivot from its restrictive stance, despite continued economic resilience.

The visual representation of these odds tells a compelling story. Nearly nine out of ten market participants are betting on a reduction to 375–400 basis points, creating a sharp probability gap that has compressed alternative scenarios to just over 12%. Such heavily skewed expectations often signal potential volatility ahead, particularly when trading sentiment becomes this one-sided.

Economic Factors Driving the Shift

Multiple economic developments are converging to support the rate cut narrative. Inflation data has been showing signs of stabilization, reducing the immediate pressure on Fed officials to maintain their restrictive policy stance. Meanwhile, upward GDP revisions suggest the economy has more underlying strength than previously anticipated, potentially giving policymakers more flexibility to adjust rates without appearing to respond to economic weakness.

The timing is also significant from a market seasonality perspective. October has historically been a pivotal month for risk assets, with cryptocurrency enthusiasts often referring to it as "Uptober" due to past performance patterns. This seasonal backdrop adds another dimension to current positioning as investors prepare for the fourth quarter.

Upcoming speeches from Vice Chair for Supervision Michael Barr and San Francisco Federal Reserve President Mary Daly will be closely monitored for any hints about the Fed's thinking. Market participants will parse every word for signs of dovish sentiment that could confirm current rate cut expectations.

Market Implications and Outlook

Should the Federal Reserve follow through with the expected rate cut, liquidity-sensitive assets across the spectrum could see significant upward momentum. Technology stocks, which are particularly responsive to interest rate changes, along with cryptocurrency markets, might experience strong rallies extending into year-end. Lower rates typically boost valuations for growth assets and increase appetite for risk-taking.

However, the heavily one-sided nature of current expectations creates potential for sharp market reactions if the Fed surprises with a different approach. If officials choose to hold rates steady and adopt hawkish rhetoric, markets could face rapid repricing with volatility likely to spike across asset classes. The concentration of expectations around a single outcome makes markets vulnerable to policy surprises.

As October unfolds, investors will be watching not just the Fed's policy decision but also the accompanying commentary and forward guidance that could shape expectations for the remainder of the year and beyond.

Usman Salis

Usman Salis

Usman Salis

Usman Salis