⬤ Europe's LNG imports have become heavily dominated by the United States over recent years, with ship-tracking data showing a dramatic shift in the supply mix. EU officials have confirmed the bloc is actively searching for alternative LNG sources beyond the US, driven by concerns about over-reliance on a single supplier and the geopolitical risks that come with it.

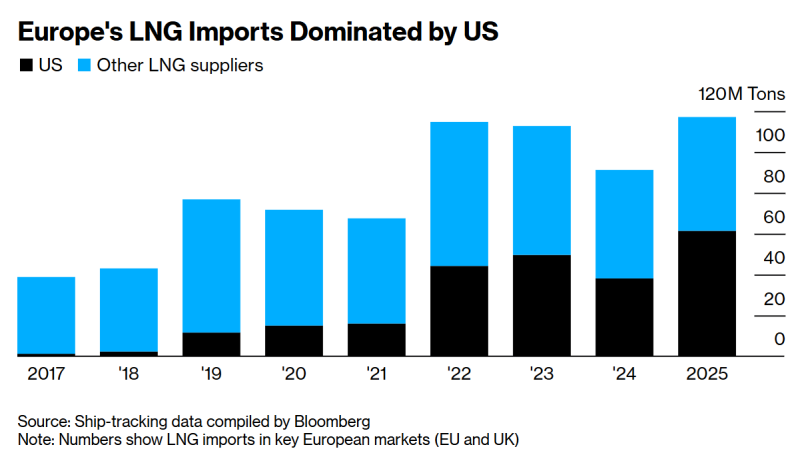

⬤ The data reveals a striking transformation in Europe's LNG landscape since 2017. Total import volumes climbed steadily across major European markets, including the EU and UK. US LNG shipments surged during this period, quickly overtaking other suppliers to become Europe's dominant LNG source. By 2022-2023, American cargoes made up the lion's share of imports, with total European LNG imports hitting around 120 million tons by 2025—a significant chunk of that coming from US terminals.

⬤ This dramatic shift happened after Europe scrambled to restructure its energy supply following the collapse of Russian pipeline gas deliveries. While other LNG suppliers continued shipping to Europe, their growth couldn't match the explosive rise in US volumes. The result? Europe's LNG supply became increasingly concentrated, making the continent more vulnerable to political and strategic developments involving its primary supplier.

⬤ These changes matter because Europe ranks among the world's biggest LNG buyers, meaning its sourcing decisions ripple through global trade flows and pricing. If the EU successfully diversifies away from US LNG, it would reshape the market for exporters, infrastructure developers, and long-term supply planning. As European leaders balance energy security against concentration risks, their choices will continue shaping LNG markets for years to come.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova