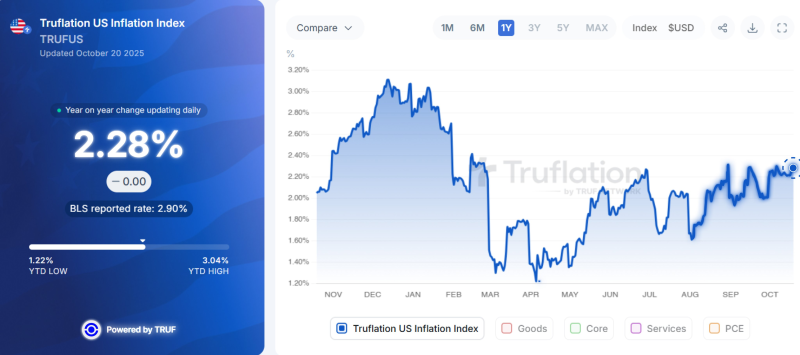

● As of October 20, 2025, Truflation shows U.S. inflation holding at 2.28%—notably lower than the last official 2.90% figure from the Bureau of Labor Statistics. With the government shutdown now in its third week, this private tracker has become a crucial alternative for gauging price trends.

● The shutdown's ripple effects go well beyond budget battles. About 80% of National Nuclear Security Administration staff are furloughed, raising security red flags. Federal unemployment claims have jumped to 7,200—more than double the norm—while air traffic control shortages are causing flight delays nationwide. These disruptions make it harder to read the real signals in the economy.

● The Treasury Department estimates the shutdown is draining $15 billion weekly from economic output. Without official reports on consumer prices, producer costs, GDP, or trade figures, the Federal Reserve and investors are flying blind on data that typically guides interest rate decisions. Some business groups have suggested temporary tax adjustments or budget reallocations to stop the bleeding, but political gridlock persists.

● The information vacuum is growing. September's jobs report never came out. Weekly jobless claims—gone. Retail sales data—missing. Critical releases like the October 30 GDP estimate and October 31 personal income report are now uncertain. This comes at a particularly awkward moment, with the Fed trying to calibrate its next move on rates.

● The Truflation team continue delivering real-time inflation readings while official channels stay dark. Markets are now leaning on independent models to understand what's actually happening with prices—a stark reminder of how quickly data infrastructure crumbles during fiscal standoffs.

● With inflation stable but visibility low, the longer this blackout lasts, the harder it becomes for anyone to make informed decisions about the economy's direction.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova