We're witnessing something remarkable unfold in today's economy. Current inflation patterns bear striking similarities to the 1970s, when multiple waves of rising prices fundamentally changed how Americans saved and invested. While this creates challenges for everyday consumers, it also presents significant opportunities for savvy investors who understand the historical playbook.

The 1970s Playbook: Three Waves of Inflation

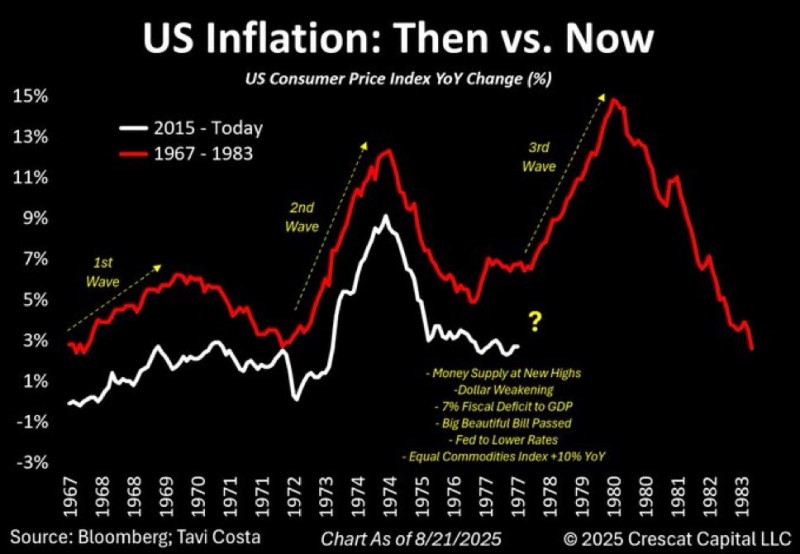

A compelling chart analysis by Comet reveals how today's CPI trajectory (white line, 2015-present) mirrors the infamous 1967-1983 period (red line). The 1970s inflation crisis unfolded in three distinct phases: the first wave climbed steadily to around 6% between 1967-1970, the second wave surged above 11% during 1973-1975 due to oil shocks and loose fiscal policy, and the third wave peaked near 14% from 1978-1980, devastating cash holders while rewarding investors in real assets.

Today's pattern shows the same telltale buildup, with the chart provocatively leaving a question mark about whether we're heading into another major inflationary surge.

Why Cash Gets Crushed

Inflation systematically destroys the purchasing power of cash savings. Even when interest rates rise, real returns typically lag behind escalating prices, making savers effectively poorer over time. History shows that investors who moved into stocks, commodities, real estate, and alternative assets during inflationary periods significantly outperformed those who stayed in cash.

Warning Signs Are Flashing

Several conditions mirror those that preceded the 1970s crisis. Money supply has reached record highs, the U.S. dollar is weakening, fiscal deficits are running near -7% of GDP, and commodity prices are rising roughly 10% year-over-year. These ingredients suggest inflation may be far from finished and could build into another powerful wave.

The Investor Advantage

While inflation punishes consumers and savers, it can be transformational for strategic investors. Just as gold and oil delivered massive returns in the 1970s, today's markets could see exceptional gains in cryptocurrency, equities, and real estate if inflation re-accelerates. The key is positioning before the next wave hits.

Usman Salis

Usman Salis

Usman Salis

Usman Salis