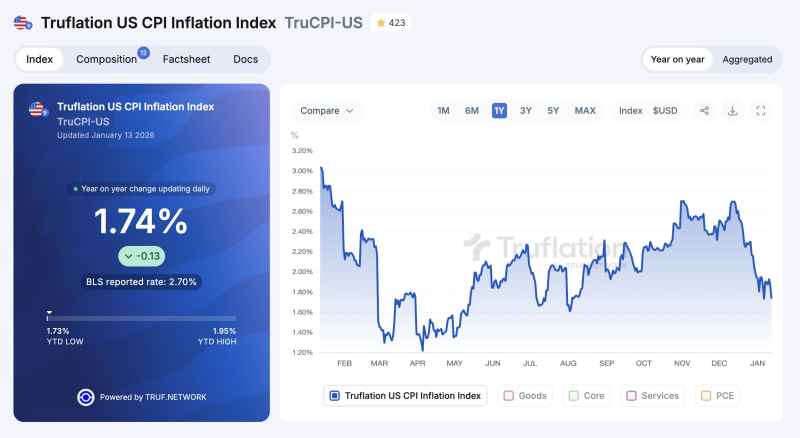

⬤ US inflation just took a notable dip according to real-time data. The Truflation US CPI Inflation Index dropped to 1.74% year over year, with the Housing category—specifically Owned Dwellings—driving the decline.

⬤ The numbers tell an interesting story. Truflation's independent inflation measure fell from 1.87% to 1.74% in just one day, updated on January 13, 2026. The current reading sits near the lower end of its recent range, hovering just above the year-to-date low of roughly 1.73%. Here's what stands out: Truflation's real-time tracker remains well below the Bureau of Labor Statistics' official CPI rate of 2.70%, highlighting the gap between transaction-based data and traditional survey methods.

⬤ The housing slowdown comes down to year-over-year comparisons. Last year at this time, mortgage rates were climbing fast, which inflated the imputed cost of homeownership and pushed housing components higher. Now, with financing costs either flat or slightly lower, that year-over-year housing inflation naturally cools off. The result? Owned Dwellings is pulling the overall Truflation index down.

⬤ This matters because housing represents one of the biggest and stickiest pieces of inflation measurements. When housing costs ease consistently, it can shift broader inflation trends and speed up how quickly headline inflation moderates. As real-time indicators like Truflation continue showing lower inflation than official figures, the focus shifts to upcoming government data and what this gap reveals about actual price dynamics and economic conditions.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi