We might be witnessing something that happens maybe twice in a lifetime. If he's right, we're about to see equities get hammered in real terms while gold and silver enter their strongest bull run in decades.

What the 45-Year Cycle Shows

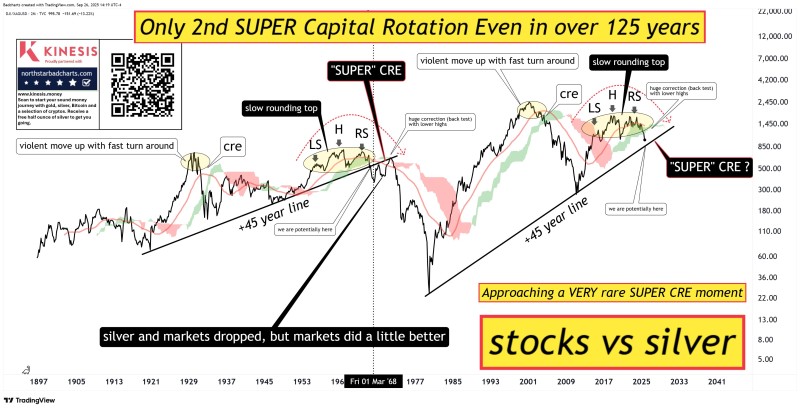

Market analyst Patrick Karim believes we're approaching only the second "SUPER" Capital Rotation Event in over 125 years. The long-term stocks versus silver chart tells a fascinating story. Every 45 years or so, capital makes a dramatic shift away from equities and into hard assets. The technical patterns are crystal clear:

- Rounding tops that signal equity exhaustion

- Head and shoulders formations confirming weakening momentum

- Breakdowns that trigger years of underperformance

We're potentially entering another "SUPER CRE" phase right now, similar to what happened in 1968-1970 when silver and gold absolutely crushed stock returns.

Why Precious Metals Are Setting Up Perfectly

The stars are aligning for this rotation in ways we haven't seen in generations. Inflation keeps eating away at real equity gains while central banks are hoarding gold like there's no tomorrow. Geopolitical chaos has investors scrambling for safety, and silver looks ridiculously cheap compared to stocks right now. When you combine these long-term cycles with current technical signals and macro conditions, it's starting to look a lot like those legendary CRE moments from the past.

If this ratio finally breaks lower, it confirms the rotation is happening. Stocks could face years of relative decline while silver and gold enter one of their most explosive multi-year bull markets ever. This isn't just another market swing - we're talking about a generational shift in how capital flows around the world.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah