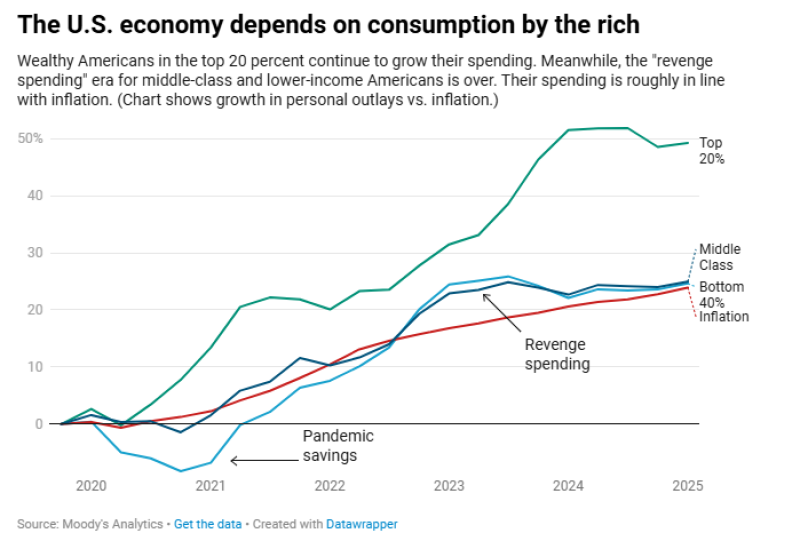

America's economy is splitting into two worlds. While the richest Americans keep opening their wallets, the other 80% have hit a wall. A new chart from Moody's Analytics shows just how dramatic this divide has become.

The numbers tell a stark story. Since 2020, the top 20% have boosted their spending by nearly 50% - way beyond what inflation would require. Meanwhile, middle-class families and lower earners are treading water. Their spending has grown just enough to match rising prices, meaning they're not actually buying more stuff than before.

The Middle Class Runs Out of Steam

Remember those pandemic stimulus checks? They gave everyone a temporary spending boost, but that money didn't last forever. For most families, the extra cash is long gone. Now they're facing the reality of higher prices for everything from groceries to gas, with paychecks that haven't kept pace.

The wealthy, however, never needed that stimulus money to begin with. They've kept spending on luxury goods, travel, and services - essentially carrying the entire economy on their backs.

What Happens When the Rich Stop Spending?

Here's where things get scary. If the top earners decide to tighten their belts - maybe because of stock market jitters or uncertainty about the future - the whole economic house of cards could tumble down.

"Whether we go into a recession will depend almost entirely on whether the top 10 to 20% of earners keep spending," warns the analysis.

That's a pretty fragile foundation for an economy. When your growth depends on just one-fifth of the population, you're walking a tightrope.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah