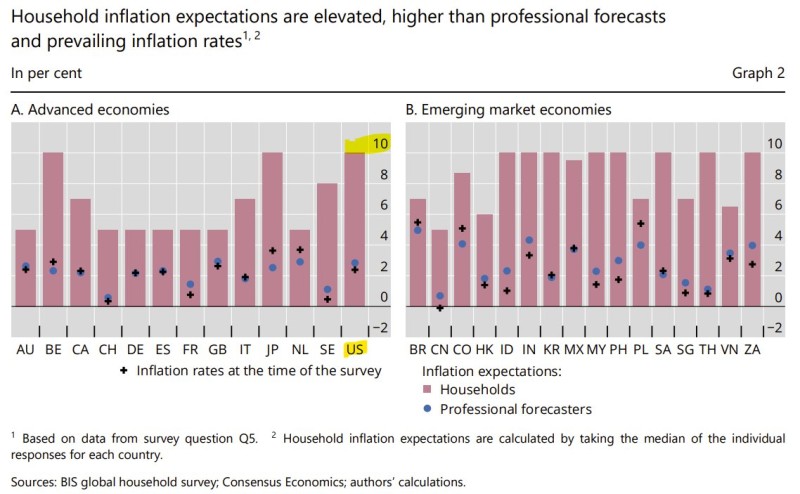

Even as official data shows U.S. inflation easing, households remain deeply skeptical. A Bank for International Settlements (BIS) survey found that American consumers expect inflation to run close to 10% - more than triple professional economists' forecasts. This stark divergence underscores how disconnected public sentiment has become from measured inflation trends.

Household Inflation Expectations Surge

The BIS survey shows household expectations consistently outpace both professional forecasts and actual inflation rates globally. In the U.S., this gap is especially pronounced. Trader Joseph Wang highlighted how households anticipate double-digit inflation despite recent moderation signs.

In most developed nations like Germany, Japan, and the U.K., households expect 4–8% inflation. The U.S. stands out with expectations near 10%, the highest among advanced economies. While emerging markets also show elevated expectations, they align more closely with actual outcomes than American projections. Professional forecasts typically match real-time inflation data, while household expectations remain systematically higher.

Why U.S. Consumers Expect Higher Inflation

Several factors explain why American households see persistent inflation. Volatile energy and food costs shape public perception more than core inflation measures. After experiencing four-decade highs during 2021–2022, households may be "anchored" to elevated expectations. Public skepticism toward official measures likely fuels higher estimates, especially with rising essentials like rent and healthcare.

Global Context: Not Just a U.S. Story

The BIS survey shows households globally expect higher inflation than professionals, suggesting lived experiences of rising costs outweigh official statistics. However, the U.S. gap is uniquely large. While forecasters see 2–3% inflation, households predict levels more than three times higher.

What This Means for Policy and Markets

High household inflation expectations carry real consequences. If consumers expect sharp price increases, they may accelerate spending or demand higher wages, creating self-fulfilling pressures. Persistently high U.S. expectations may complicate the Federal Reserve's credibility on inflation control. While actual inflation has cooled, perception risks could drive volatility in consumer sentiment and bond markets.

Peter Smith

Peter Smith

Peter Smith

Peter Smith