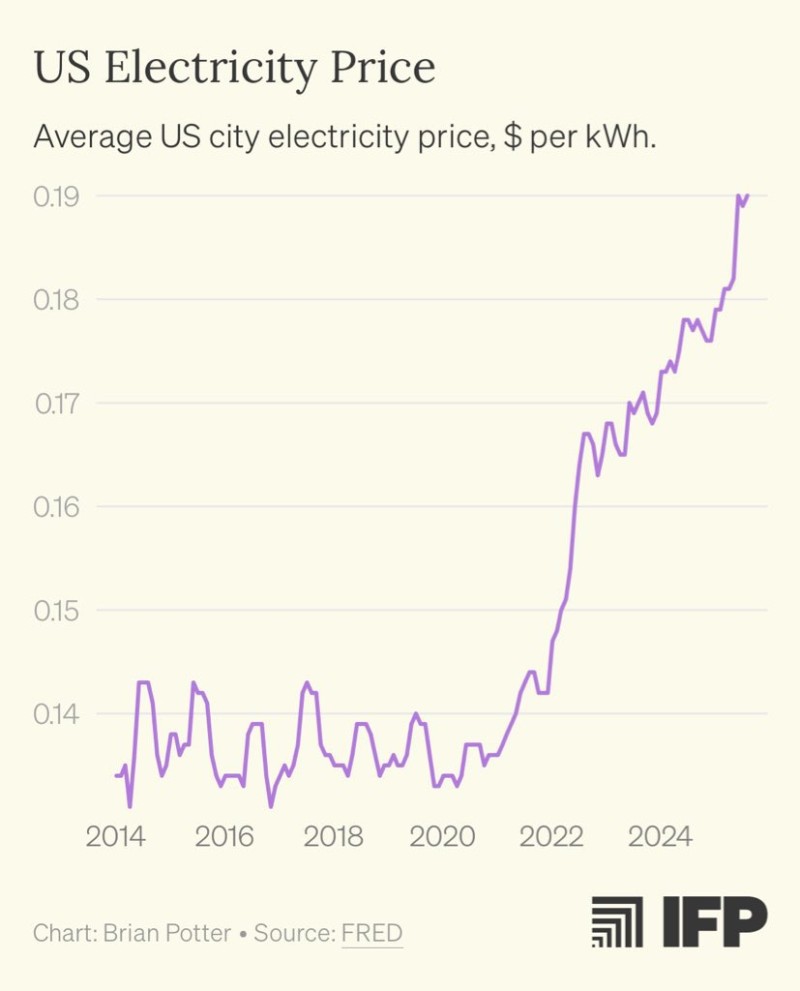

For years, electricity costs across American cities stayed remarkably stable. Since 2021, however, prices have surged to historic levels, climbing to nearly $0.19 per kWh by 2025. What was once a predictable expense has become a growing burden, worsened by inflation.

Chart Analysis: Breaking Point in Power Costs

The data shows two distinct eras, as datahazard trader analysis notes.

From 2014 to 2020, prices held steady within $0.13–$0.15 per kWh. Then 2021 shattered this stability completely. Prices broke through $0.16 in 2021-2022, then accelerated to around $0.19 per kWh by 2025. This represents the steepest climb in over a decade, following a parabolic curve that mirrors broader inflation but hits harder given electricity's essential role. While the raw price surge is clear, failing to adjust for inflation makes the real consumer impact far more severe.

Why Electricity Costs Are Soaring

Several forces drive this surge. Fuel costs became volatile after global supply shocks, particularly affecting natural gas. Grid modernization and renewable integration require massive capital investments passed to consumers. Policy transitions away from fossil fuels create short-term cost spikes. Most critically, inflation has eroded purchasing power, making real electricity costs even higher than nominal prices suggest.

What's Next for Power Costs

Electricity demand keeps growing with EV adoption, data center expansion, and industrial electrification. Without major capacity increases and efficiency gains, consumers face structurally higher bills for years. While renewables and nuclear could bring long-term stability, the near-term outlook points to permanently elevated electricity costs reshaping American budgets.

Peter Smith

Peter Smith

Peter Smith

Peter Smith