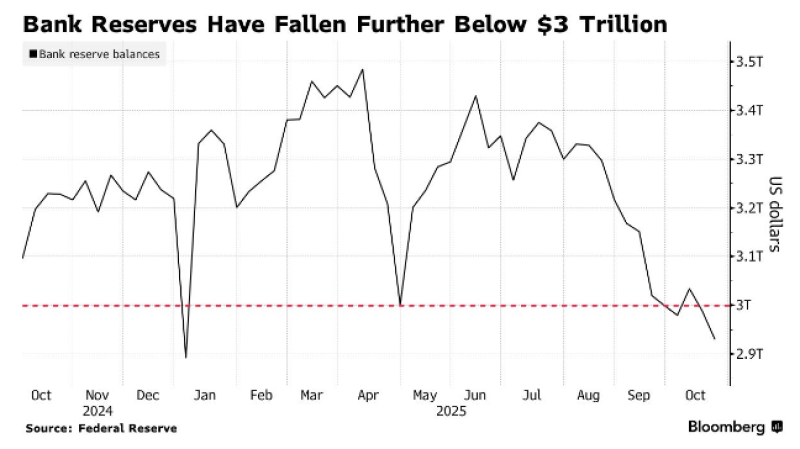

Bank reserves in the US financial system have slipped below the $3 trillion threshold, hitting their lowest point since the beginning of the year. This steady decline through the second half of 2025 could have significant implications for credit markets and monetary policy going forward.

Chart Analysis: Reserves Continue Their Descent

According to data shared by Barchart trader and sourced from the Federal Reserve, bank reserve balances have dropped to roughly $2.9 trillion. The Bloomberg-style chart shows a clear downward path, with reserves falling from around $3.3 trillion in mid-2025 before accelerating lower from July through October.

The breach below the $3 trillion red line in early October marks a notable moment. While a similar dip happened in January followed by a spring rebound, this decline appears deeper and more persistent, pointing to genuine tightening rather than temporary noise.

What's Driving the Decline

Several forces are squeezing liquidity out of the banking system. The Federal Reserve's quantitative tightening program keeps draining reserves as securities roll off the balance sheet without replacement. Meanwhile, heavy Treasury borrowing to cover large deficits is pulling liquidity from money markets. And with interest rates elevated, investors are moving cash from bank deposits into money market funds, further accelerating the outflows. These dynamics have pushed reserves down to levels that historically preceded funding market stress, like the 2019 repo crisis.

Why It Matters for Financial Stability

Lower bank reserves aren't just a technical detail—they measure how much liquidity cushion the system has. When reserves shrink, banks have less buffer against unexpected funding needs, which can amplify volatility in repo and overnight lending markets. Some analysts warn that if reserves fall toward $2.8 trillion, we could see tighter credit conditions or even liquidity crunches that force the Fed's hand. That said, tools like the Standing Repo Facility and healthy reserve levels at major banks may help absorb the shock for now.

The Fed's Balancing Act

This liquidity squeeze comes at an awkward time for the Federal Reserve. With inflation still above target but growth slowing, the central bank faces a tricky choice: keep tightening to control prices or step in to support market liquidity. There's growing concern among market watchers that the combination of quantitative tightening, high rates, and fiscal expansion may be over-tightening conditions, creating risks for both credit markets and the broader economy.

Peter Smith

Peter Smith

Peter Smith

Peter Smith