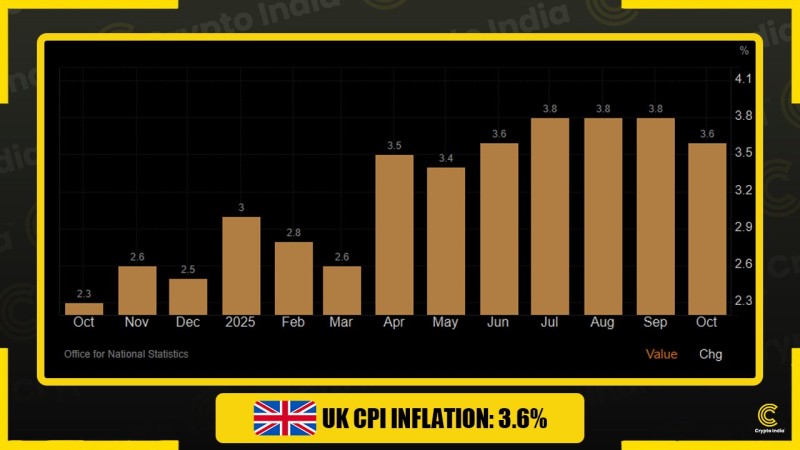

The UK just got its first real break from rising prices in months. Fresh data from the Office for National Statistics shows consumer prices climbed 3.6% year-over-year in October—down from the 3.8% level that held steady through the summer. After spending most of 2025 watching inflation creep higher, this marks the first tangible sign that price pressures might actually be easing.

UK CPI Trend Moderates After Summer Peaks

A recently shared chart tracking the latest CPI figures highlights just how sustained this year's inflation run has been.

The numbers tell a clear story: inflation started the previous October at 2.3%, then climbed steadily through the winter and spring before hitting a sustained peak of 3.8% from July through September. October's 3.6% reading breaks that pattern for the first time.

Why Inflation Is Easing Now

Energy and commodity prices have stabilized after a volatile stretch. Global fuel costs and raw materials aren't climbing the way they were earlier in the year, which takes pressure off supply chains and transportation expenses. Consumers have also pulled back on discretionary spending, with demand in categories like services cooling noticeably. The Bank of England's rate hikes are working their way through the system too, dampening credit demand and gradually lowering inflationary pressures.

Market and Policy Implications

The lower CPI figure has markets speculating about earlier rate cuts, though policymakers aren't rushing to change course. They're focused on making sure inflation doesn't just flatten out at elevated levels instead of continuing down toward the 2% target. For households, the drop is a step in the right direction, but inflation is still running well above where it should be. Even modest easing could start improving real wages and give people more breathing room heading into 2026.

Early Signs of Stabilisation

October's 3.6% reading isn't a game-changer, but it's the first real evidence that inflationary momentum might be losing steam. Whether this decline sticks around will depend heavily on energy markets, global economic conditions, and how UK consumers respond. For now, the data suggests the country could be moving toward gradual price stability—offering cautious optimism that the worst of this inflation cycle might finally be behind us.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov