After months of turbulence, UK inflation appears to be finding its footing. The Office for National Statistics reports that consumer price inflation stayed at 3.8% in September, matching August's figure and falling just short of the 4% analysts had predicted. This signals a precarious balance: while the dramatic price surges of 2024 have clearly cooled off, inflation still sits well above the Bank of England's 2% target, keeping monetary authorities on edge.

Inflation Figures and Market Response

The data, highlighted by trader Crypto India on X, suggests inflationary pressures have hit pause rather than reversed course. Energy and food costs have pulled back somewhat, but services and housing expenses continue pushing prices upward.

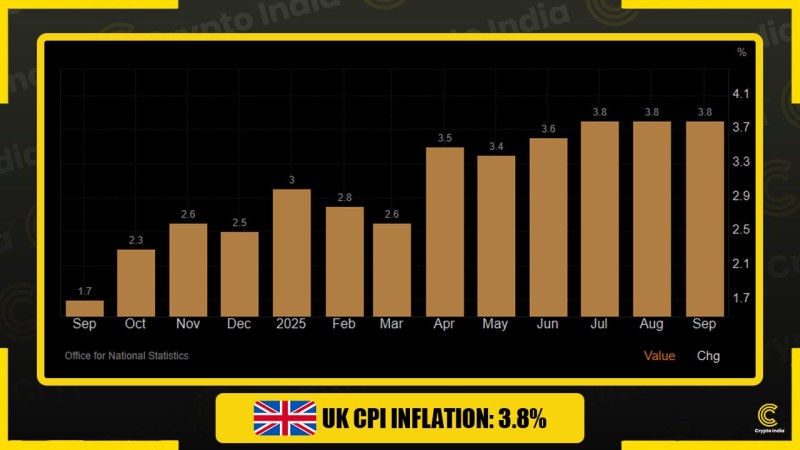

The accompanying chart tells the story clearly. Starting from 1.7% in September 2024, inflation climbed steeply through late 2024 and early 2025, hitting 3.5% in April before settling around 3.6-3.8% through the summer months. What we're seeing now is a plateau, a period where inflation neither accelerates nor meaningfully retreats.

What the Chart Reveals

Looking at the visual data, there's a distinct upward trend that flattens out near the 3.8-4% mark, resembling what traders would call a resistance zone. Since June, monthly readings have repeatedly approached but failed to breach this psychological barrier. This pattern indicates weakening inflation momentum, though not yet a reversal. Economists point to wage growth in service industries and persistent rent increases as the main culprits. These factors create a feedback loop that keeps consumer prices elevated. Without movement in these areas, the Bank of England faces an uphill battle to bring down inflation quickly.

What This Means for Policy and the Economy

These figures will likely push back any hopes for interest rate cuts. The Bank of England has made it clear that cutting rates too soon could reignite inflation, and a reading hovering near 4% leaves little wiggle room for action. For ordinary people, this translates to continued strain from high mortgage rates and borrowing costs, even as overall price growth steadies. Looking ahead, if current trends hold, analysts expect UK inflation to gradually drift down toward 3% by mid-2026, assuming energy markets stay stable and wage pressures ease. For now, the British economy remains stuck in neutral, neither overheating nor fully recovering, as policymakers try to thread the needle between controlling inflation and supporting growth.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah