A symbolic turning point has hit the European bond market: France's 10-year yield has climbed above Italy's for the first time in recent memory. This inversion of the France–Italy spread signals a fundamental reassessment of sovereign risk in the eurozone, surprising investors who long considered France the safer bet compared to Italy.

France Overtakes Italy in Yields

Market strategist Stephane Deo highlighted that France's 10-year yield now stands at 3.469%, just above Italy's 3.464%. Historically, Italy's higher debt burden meant its borrowing costs were well above France's.

The fact that this relationship has flipped underscores growing concerns about France's fiscal situation and represents a remarkable shift in how markets perceive European sovereign risk.

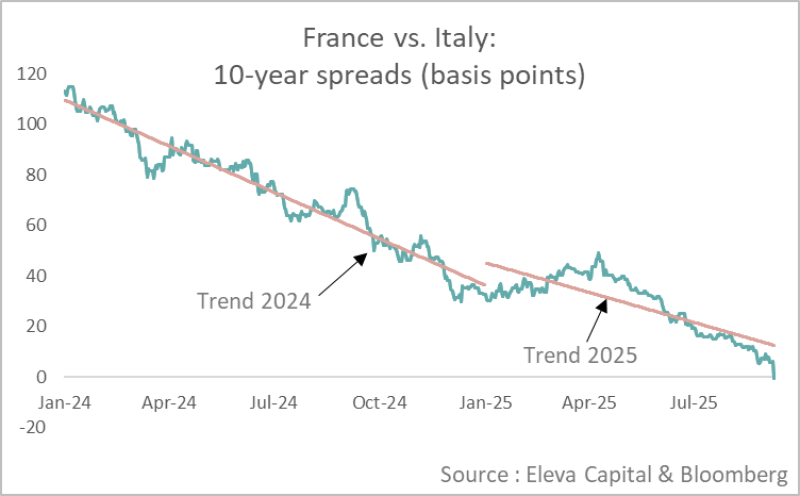

Chart Analysis: France–Italy Spread

The chart from Eleva Capital & Bloomberg captures this dramatic trend clearly. The 2024 data shows the spread narrowed steadily from over 100 basis points to around 40 bps by late 2024. The 2025 trend accelerated this decline, bringing the spread close to zero and eventually negative. As of September 2025, the spread sits below zero, meaning France is paying more to borrow than Italy. The consistent downward slope confirms this isn't a short-term move, but a structural shift that has unfolded over nearly two years.

What's Driving the Shift?

Several forces are pushing this inversion. France's fiscal strain is evident through rising deficits, heavy bond issuance, and political uncertainty that are pressuring yields higher. Meanwhile, Italian support has emerged from relative stability, backed by ECB assistance and stronger-than-expected growth resilience. More broadly, eurozone repricing is occurring as investors rebalance their risk views, no longer treating France as the unquestioned "core" safe-haven it once was.

Investor Takeaways

France now faces higher financing costs, which may prompt renewed scrutiny from rating agencies and could impact the government's ability to fund ambitious spending programs. Italy gains relative breathing room in this new environment, though its structural debt issues certainly remain. For eurozone markets overall, this represents a paradigm shift where traditional assumptions about sovereign credit risk are being fundamentally challenged and rewritten.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah