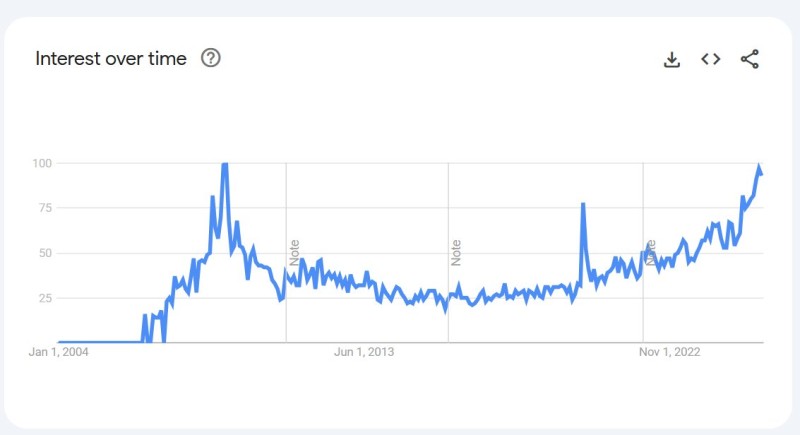

Recent Google Trends data shows American households are desperately seeking mortgage relief, with search activity hitting levels unseen since the 2008–2009 financial crisis. The spike reflects mounting strain on families grappling with stubborn inflation and mortgage rates that have kept affordability out of reach.

Chart Analysis and Context

The chart tracks search interest for "help with mortgage" since 2004. Searches spiked dramatically during the 2007–2009 financial crisis as foreclosures surged, then remained muted through 2020 thanks to low rates and easier refinancing. Starting in 2021, searches began climbing steadily, accelerating sharply over the past two years to match March 2009 levels. According to trader Joe Consorti, U.S. inflation has stayed above 2.5% for over four consecutive years, steadily eroding household budgets.

High mortgage rates continue discouraging refinancing, while home prices remain elevated and pandemic savings have been depleted, leaving homeowners increasingly vulnerable to financial shocks.

Economic Implications

This surge points to broader financial vulnerabilities, including potential upticks in loan delinquencies that could ripple through the banking sector. Consumer spending may weaken as more income goes toward housing, potentially dragging on GDP growth. Historically, similar spikes have preceded deeper economic distress, making this a crucial signal for policymakers and investors monitoring systemic risk.

Peter Smith

Peter Smith

Peter Smith

Peter Smith