The Federal Reserve's next move has become Wall Street's worst-kept secret. After months of keeping rates elevated to battle inflation, markets are now pricing in a dramatic policy reversal that could reshape the economic landscape. But as traders pile into bets on aggressive rate cuts, a nagging question remains: could this monetary about-face end up creating the very problem it's meant to solve?

With inflation showing signs of cooling and economic growth concerns mounting, the Fed appears ready to shift gears. Yet the market's overwhelming confidence in multiple rate cuts might be setting up a dangerous feedback loop where easier money policy reignites price pressures just as policymakers thought they had them under control.

September Cut: Done Deal According to Markets

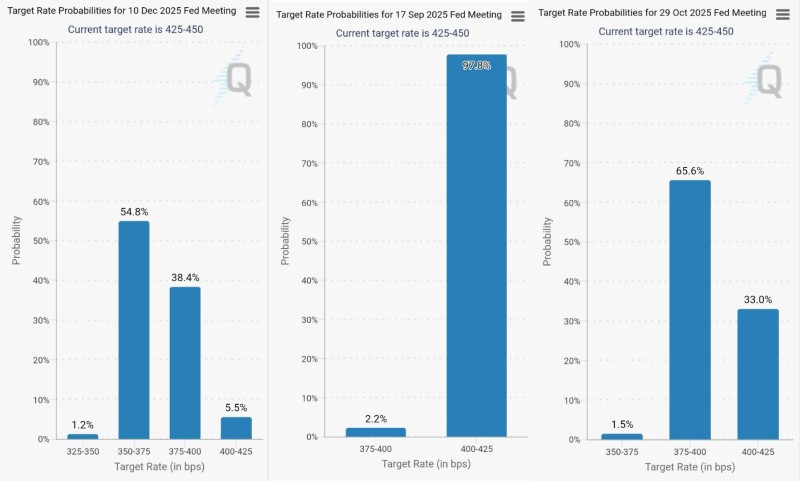

The latest CME FedWatch Tool numbers tell a pretty clear story – traders aren't just confident about a September 17th rate cut, they're treating it like it's already happened. We're talking 100% certainty here, with nearly 98% of bets placed on rates dropping to the 400-425 basis point range.

That's the kind of market confidence you don't see every day. When traders are this sure about Fed policy, it usually means something's already baked into asset prices well before the actual announcement.

Two More Cuts on the Horizon

The rate-cutting party doesn't stop there. Market pricing suggests the Fed's got two more cuts lined up before 2025 wraps up:

Come October 29th, there's a 65.6% chance we'll see another quarter-point drop to 375-400 basis points. Then by December 10th, odds are sitting at 54.8% for yet another cut down to 350-375 basis points.

If this plays out, we're looking at a full percentage point of easing in just four months – that's a pretty aggressive pivot toward looser monetary policy.

The Inflation Wild Card

Here's where things get tricky. Sure, lower rates make borrowing cheaper and can give the economy a nice boost. But there's a flip side that's got some folks worried. When you pump more money into the system and make credit easier to get, prices tend to follow suit.

If consumer demand stays hot and businesses keep spending, we could see inflation creep back up faster than anyone wants. That puts the Fed in a real bind – do they stick with the easing plan or slam the brakes if prices start running wild again?

The whole thing's a balancing act between keeping growth humming and preventing inflation from getting out of hand. And given how markets have already locked in these cuts, the Fed might find their hands tied even if economic conditions shift.

Usman Salis

Usman Salis

Usman Salis

Usman Salis