⬤ Japan's bond market just hit a major turning point. Yields on 40-year government bonds climbed past 4% for the first time in years, sparking fresh questions about where Japanese money will flow next. For decades, rock-bottom rates at home pushed investors to hunt for returns overseas. Now that domestic bonds are finally paying decent yields, the calculus might be changing.

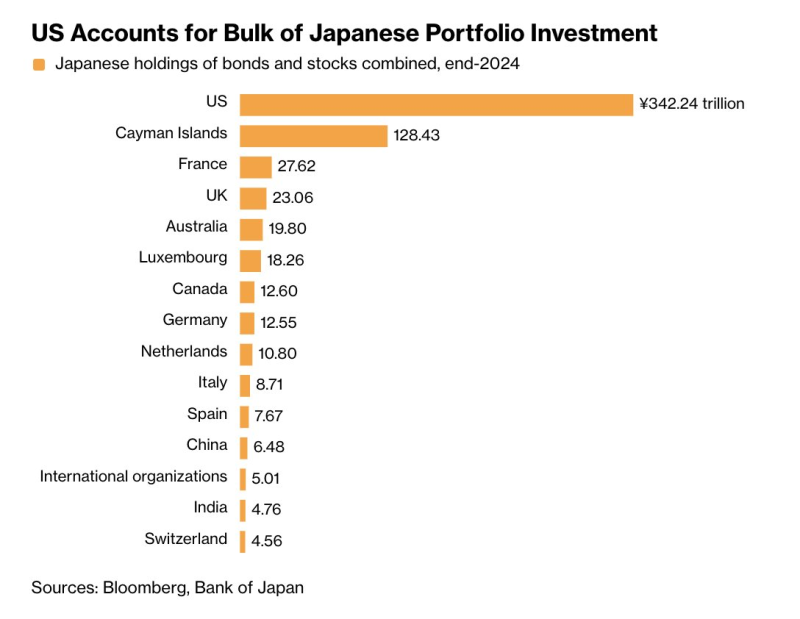

⬤ The numbers tell the story. Japanese investors have parked roughly $5 trillion in foreign markets, with the lion's share landing in the United States—about ¥342.24 trillion worth of bonds and stocks. The Cayman Islands comes in second at ¥128.43 trillion, followed by France (¥27.62 trillion), the UK (¥23.06 trillion), and smaller positions in Australia, Luxembourg, Canada, and Germany. It's clear where Japan's capital has been chasing returns.

Roughly $5 trillion of Japanese capital is invested overseas... a potential market exposure of around $7 trillion linked to these flows.

⬤ Here's why it matters: if Japanese bonds keep offering competitive returns, some of that overseas money could start heading home. We're not talking about a sudden exodus, but even gradual shifts could ripple through global markets. The US has gotten used to steady Japanese buying. Any pullback would mean American markets need to find new sources of demand or adjust prices accordingly. With interest rates still volatile worldwide, investors are already recalculating where to put their money—and Japan's new yield reality just added another variable to the equation.

Usman Salis

Usman Salis

Usman Salis

Usman Salis