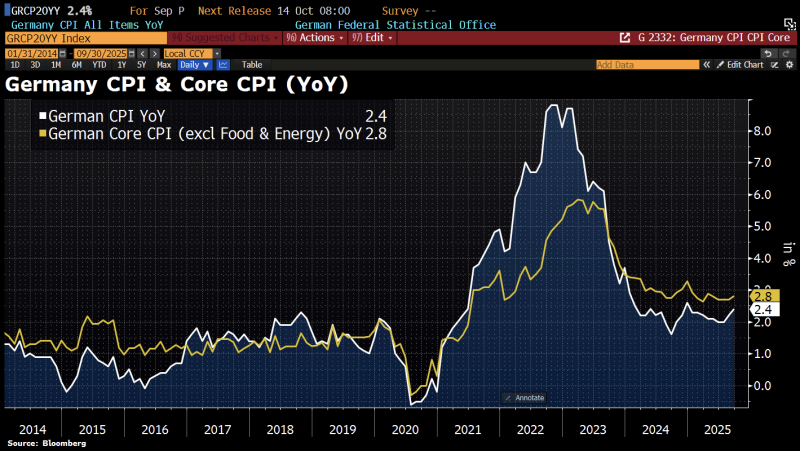

Germany's inflation just refused to cooperate. September brought an unwelcome surprise as headline CPI jumped from 2.2% to 2.4%, while core inflation - the metric that actually matters - crept up to 2.8%.

What's Really Happening

According to data shared by Holger Zschaepitz, Europe's economic powerhouse is discovering that getting inflation down is way harder than everyone hoped. Energy prices didn't fall as much as expected, and that's just the beginning of the problem.

The headline number tells one story, but core inflation tells another. Strip out the volatile stuff like food and energy, and you see prices that just won't budge. Core CPI has been sitting above headline inflation since early 2023, and it's not backing down. This isn't a blip - it's a pattern. Services costs keep climbing, housing stays expensive, and the whole thing looks increasingly sticky.

Three things are keeping pressure on. First, energy markets have stopped doing everyone favors - wholesale prices fell hard from the 2022 crisis, but that decline has basically stalled out. Second, German workers are getting paid more, and those wage gains are flowing straight into service sector prices. Third, government support programs like energy subsidies have smoothed things over but might be preventing prices from actually normalizing. It's a mess of competing forces, and none of them are pointing toward easy disinflation.

The key factors keeping inflation elevated:

- Energy price declines have stalled after the initial post-crisis drop

- Strong wage growth from union negotiations feeding into services inflation

- Government subsidies masking true price pressures and delaying normalization

- Sticky housing and services costs that won't respond to monetary tightening

What This Means for Markets

The European Central Bank just got more complicated. Headline inflation is moving the right direction, technically, but that September uptick changes the conversation. If core stays this stubborn, the ECB might have to keep rates higher for longer than markets are pricing in. Bond yields could push up if traders start betting on extended tightening. Stocks won't love that either, especially companies already squeezed on margins.

Germany's numbers matter because Germany is Europe's anchor. Where it goes, ECB policy follows. And right now, it's not going toward 2% inflation fast enough. Investors betting on quick rate cuts might need to rethink that trade.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah