Something fascinating is happening in the American economy right now. While families are tightening their belts and spending less, tech companies are going all-in on massive data center investments to power the AI revolution. It's like watching two different economies play out at the same time – and the outcome will shape America's economic future.

Shoppers Are Pulling Back Hard

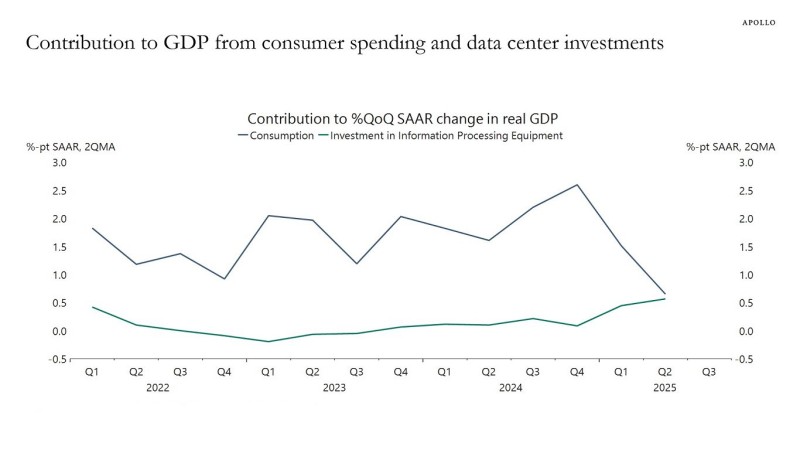

The numbers tell a pretty stark story. Consumer spending – which normally drives about 70% of everything we produce – has hit the brakes. We went from people spending at a solid 2.6% growth rate at the end of 2024 to barely 1% by summer 2025. That's a massive drop in just six months.

It's not hard to see why. Between stubborn inflation, expensive loans, and wages that aren't keeping up, regular Americans are just being more careful with their money. This kind of sharp pullback in spending usually means trouble ahead.

Meanwhile, Tech Is Building Like Crazy

But here's where it gets interesting. While consumers are cutting back, businesses are pouring money into data centers and AI infrastructure like there's no tomorrow. These investments are now contributing over 0.5% to GDP growth – the strongest we've seen in three years.

This isn't just another tech bubble. Companies genuinely need massive computing power to run AI systems, and they're willing to pay big to get it. From Amazon to Microsoft to startups you've never heard of, everyone's building data centers.

The Big Question: What Wins?

So we're left with this really important question: Can all this AI investment make up for Americans spending less? Historically, when consumers stop buying, the economy struggles. But we might be witnessing something new – an economy that can grow even when households pull back, powered instead by the digital transformation.

The next few quarters will tell us whether America's economic engine can run on silicon and servers instead of shopping and services. It's a test case for how modern economies actually work.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah