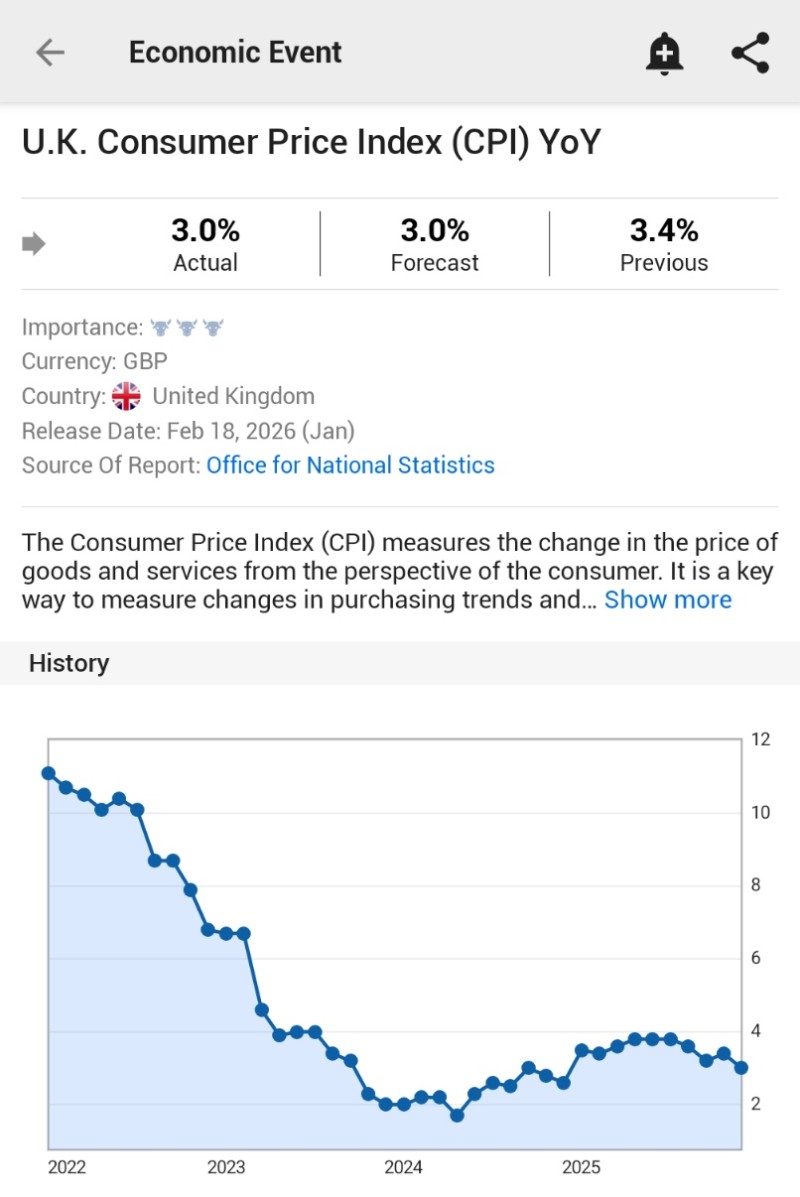

⬤ UK inflation data for January, released February 18, 2026, showed the Consumer Price Index rising 3.0% year over year, per the Office for National Statistics. The number matched the 3.0% estimate exactly and came down from 3.4% the month prior, making it the lowest annual inflation print since March 2025. As Investing.com reported, the figure aligned with market expectations while continuing the broader cooling trend.

⬤ This marks another step in a longer disinflationary story. UK inflation cooling trend is visible in the data: CPI peaked above 10% back in 2022 before dropping sharply through 2023 and settling into the 2% to 4% range throughout 2024 and 2025. The latest reading keeps inflation above the Bank of England's 2% target, but the direction is clearly softer compared to recent months.

With CPI aligning exactly with estimates, the release primarily confirmed the existing trajectory rather than introducing a new trend.

⬤ Because the data landed right on forecast, it reduced the chances of any sharp moves in GBP-linked assets right after the release. Inflation prints matter for rate expectations and central bank guidance, but a result that matches consensus tends to reinforce the current narrative rather than shake things up. For now, the Bank of England's path forward stays broadly unchanged.

⬤ Price pressures in the UK are easing, but they haven't disappeared. Here's the inflation reality check CPI delivers: at 3.0%, prices are still rising faster than the Bank of England's target, keeping inflation relevant for GBP currency pairs, UK gilt yields, and broader macro sentiment tied to the British economy. Watch the next CPI release for signs of whether the cooling trend holds or stalls.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi