The Federal Reserve's recent rate cut comes at an unusual time when inflationary pressures haven't fully subsided. While headline CPI has declined from its 2022 peak, core services - particularly housing - continue pushing year-over-year inflation above 3%. The situation presents a curious paradox: loosening monetary policy while key inflation metrics remain elevated.

Core Services Drive Persistent Inflation

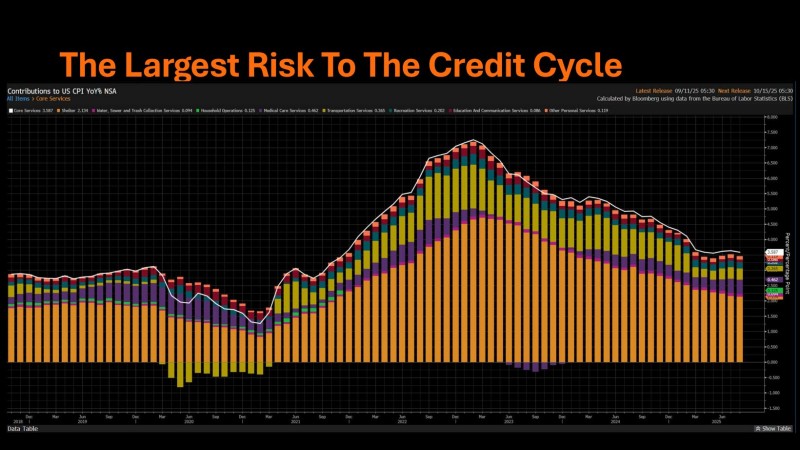

Housing costs remain the primary culprit behind sticky inflation, consistently contributing over 2 percentage points to the overall rate. As Capital Flows analysis reveals, shelter inflation has proven remarkably persistent, with other services like transportation, medical care, and utilities adding to the pressure.

This trend explains why inflation has been more stubborn than many economists predicted. Even as goods prices fell and supply chains normalized, service-based inflation has kept the Fed in a challenging position.

The data shows that while goods deflation provided some relief, it wasn't enough to offset the upward pressure from services. This creates a complex environment where traditional monetary policy tools face diminishing effectiveness against structural inflationary forces.

The Fed's Dilemma: Economics or Expediency?

The central bank's decision to cut rates while core inflation remains above target appears to deviate from conventional monetary policy wisdom. Typically, central banks wait until inflation is firmly under control before easing conditions. The current approach risks reigniting price pressures just as the economy showed signs of cooling.

This timing raises legitimate questions about whether the Fed is prioritizing economic stability or responding to political and market pressures. Critics suggest that framing rate cuts as promoting "stability" may overlook the potential for creating new imbalances in the system.

Credit Cycle Implications and Market Risks

The broader concern extends beyond immediate inflation metrics to the health of the credit cycle. Rate cuts may provide short-term relief to markets and borrowers, but they could amplify risks if inflation proves more persistent than expected. Should price pressures resurface, the Fed might need to reverse course quickly, creating whipsaw effects across financial markets.

This dynamic could squeeze both consumers dealing with rising shelter costs and corporations facing uncertain borrowing conditions. The result might be greater financial instability down the road, even if current conditions appear manageable.

Looking Ahead: A Delicate Balance

The key variable to watch remains shelter inflation and whether it finally begins moderating. If housing costs continue rising, the Fed may face a credibility crisis—caught between market expectations for continued easing and the need to address persistent price pressures.

For investors, this environment suggests heightened volatility ahead. While the "stability" narrative may hold in the near term, underlying inflation dynamics indicate the story is far from over. The Fed's current path may provide temporary relief, but it could come at the cost of greater challenges ahead.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah