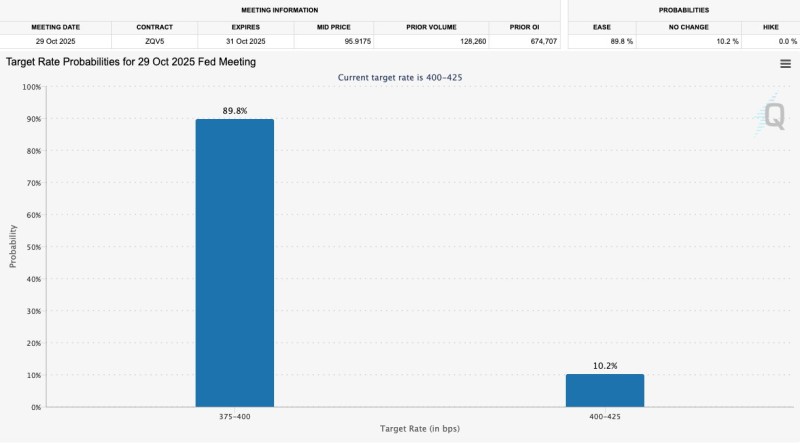

The writing's on the wall for October 29th. The Federal Reserve's go-to inflation measure - Personal Consumption Expenditures - held steady at 2.7% in August, hitting expectations dead-on. That's all the futures market needed to hear. We're now looking at 89.8% odds of a rate cut in just five weeks, making this one of the most telegraphed Fed moves in recent memory.

PCE Gives Fed the Green Light

The Fed has always treated PCE as their north star for inflation, and August's reading couldn't have been cleaner. Coming in exactly at 2.7% year-over-year removes any drama from the equation. As Satoshi Flipper pointed out, this basically seals the deal for another cut. The numbers don't lie:

- 89.8% chance of rates dropping to 3.75%-4.00%

- 10.2% chance they stay put at 4.00%-4.25%

- 0% chance of a hike

What This Means for Your Portfolio

Lower rates are like rocket fuel for certain assets. Growth stocks and tech names usually get the first boost since cheaper money makes future earnings worth more today. Crypto has historically loved Fed easing cycles too - Bitcoin and Ethereum could see some serious action if this cut materializes. Don't forget about the dollar either. A dovish Fed typically weakens the greenback, which is music to gold and silver bugs' ears.

Sure, markets are treating October like a foregone conclusion, but the Fed loves keeping some wiggle room in their messaging. They'll probably stay cautiously optimistic in their guidance, especially with global uncertainties still floating around. Still, when you've got 90% odds on anything in markets, that's about as close to a sure thing as you get.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah