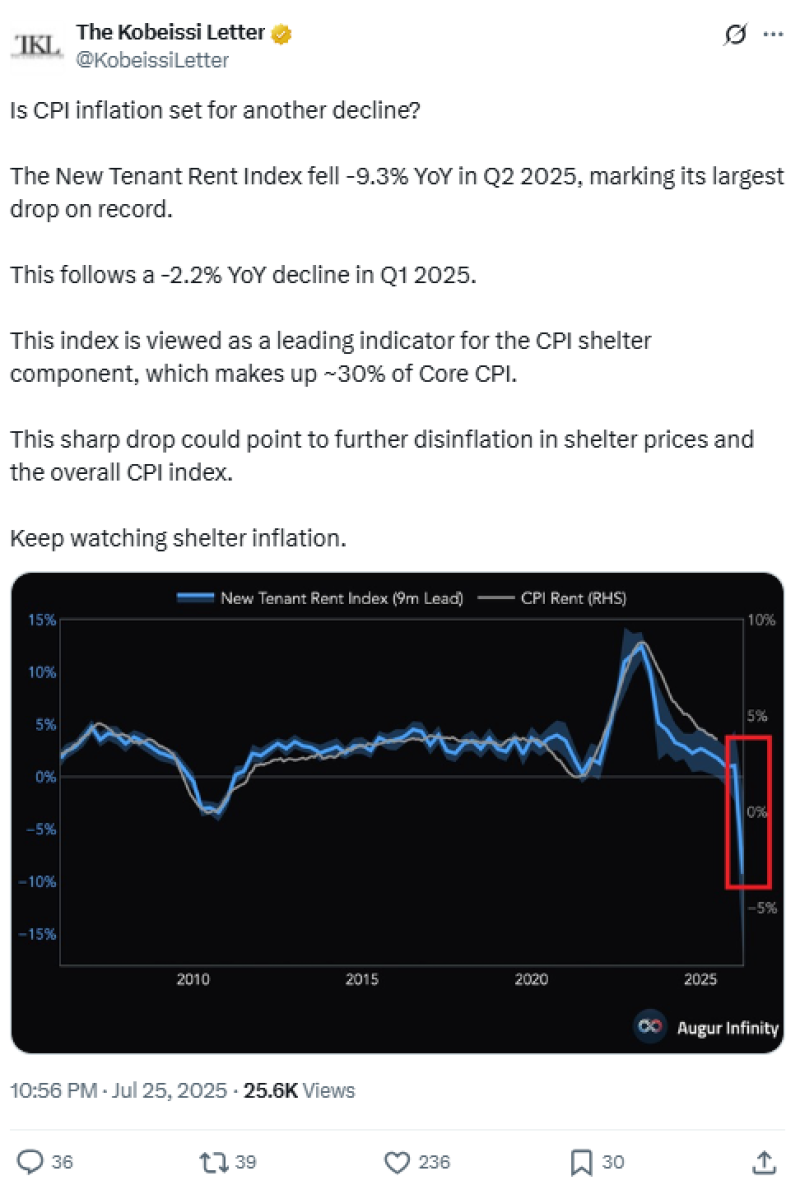

U.S. rental market data indicates a significant cooling in shelter costs, potentially signaling a broader decline in inflation. The New Tenant Rent Index, known as a leading indicator for shelter components of CPI, recorded a sharp -9.3% year-over-year drop in Q2 2025—its largest decline on record. This follows a -2.2% YoY drop in, raising expectations of further disinflation across the economy.

Rental Prices Signal CPI Weakness

The chart shows the New Tenant Rent Index (blue line) diving into negative territory, with the CPI Rent (grey line) also tre9-month lead on shelter inflation, which accounts for about 30% of Core CPI. The current decline suggests that CPI inflation may continue to ease in the months ahead.

Market Implications of Disinflation

The steep fall in rental prices could shift market sentiment regarding Federal Reserve policy. Lower shelter inflation could give the Fed room to consider rate cuts sooner, potentially boosting risk assets. Analysts warn that the trend in the rental index will be a crucial indicator for market dynamics in the coming quarters.

The -9.3% drop in Q2 2025 marks a historical decline in the New Tenant Rent Index. If the trend persists, it could further ease Core CPI, confirming a disinflationary trajectory for the U.S. economy.

Peter Smith

Peter Smith

Peter Smith

Peter Smith