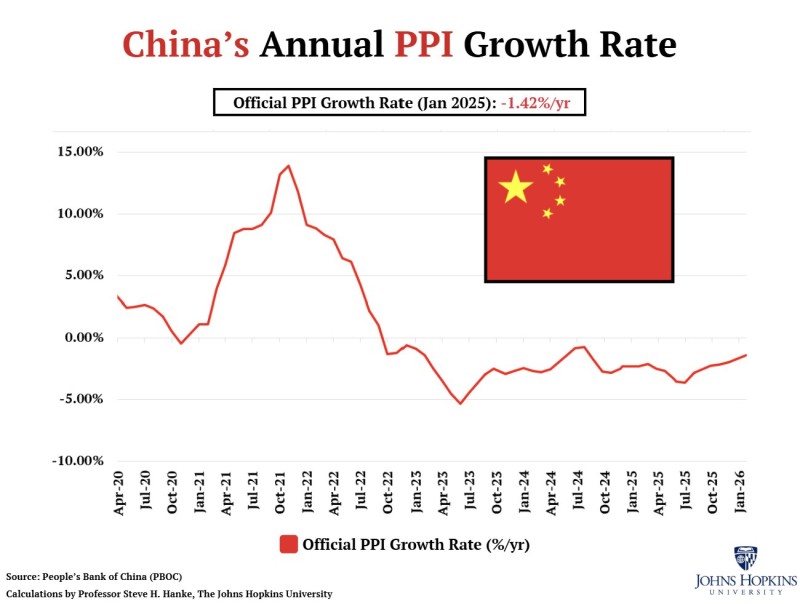

⬤ China's Producer Price Index dropped 1.42% year-over-year in January 2025, extending a deflation streak that has now persisted for three straight years. The January reading confirms that factory-gate pricing pressure remains deeply entrenched, reflecting broader weakness in upstream industrial conditions rather than a temporary blip.

⬤ The latest data continues a sharp reversal from 2021, when China PPI briefly topped 10% before tumbling into negative territory through 2022 and staying below zero throughout 2023, 2024, and into early 2025. According to economist Steve Hanke, this prolonged deflation is closely tied to "anemic money supply growth," suggesting that subdued liquidity conditions are dampening price formation across the producer sector. As Hanke noted in his analysis, the sustained negative PPI profile underscores how monetary expansion—or lack thereof—directly shapes inflation and disinflation cycles. For additional context on China's broader price environment, see China CPI falls to -0.4% and NDR inflation model drops below zero.

⬤ Producer deflation at this scale matters beyond China's borders. As the world's manufacturing hub, persistent weakness in China PPI ripples through global supply chains, influencing goods pricing, cost structures, and sentiment around demand conditions worldwide. Extended factory-gate deflation can signal softening industrial activity, lower input costs for global manufacturers, and shifting expectations around inflation trends in major economies. For perspective on how money supply dynamics interact with pricing pressures elsewhere, check out US money supply growth falls below Golden Rate.

⬤ The three-year deflation trend raises questions about the effectiveness of policy support and the health of domestic demand. While lower producer prices can ease cost burdens for downstream industries, prolonged deflation often reflects overcapacity, weak consumption, and fragile business sentiment—dynamics that could complicate China's growth outlook and global macro conditions in the months ahead.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah