Canada's inflation rate climbed to 2.4% year-over-year in September 2025, pushed up by stubborn increases in food and gasoline prices. The uptick highlights the ongoing financial squeeze many households face, particularly when it comes to essentials like groceries and fuel.

Food Prices Refuse to Cool Down

Trader Marc Nixon captured the public mood in a viral post, pointing out that "Canada's inflation just jumped to 2.4%, driven by food and gas.

Remember when the Liberals swore inflation is dead? Yeah, well, it just came back from the grave and it's eating your grocery budget." His comment reflects frustration backed by fresh Statistics Canada data showing grocery prices climbing faster than most other categories.

Official figures reveal that food bought from stores rose 4.0% in September compared to the same month last year. Even though energy prices moderated earlier in 2025, grocery inflation has stayed stubbornly high due to rising costs for meat, dairy, and produce.

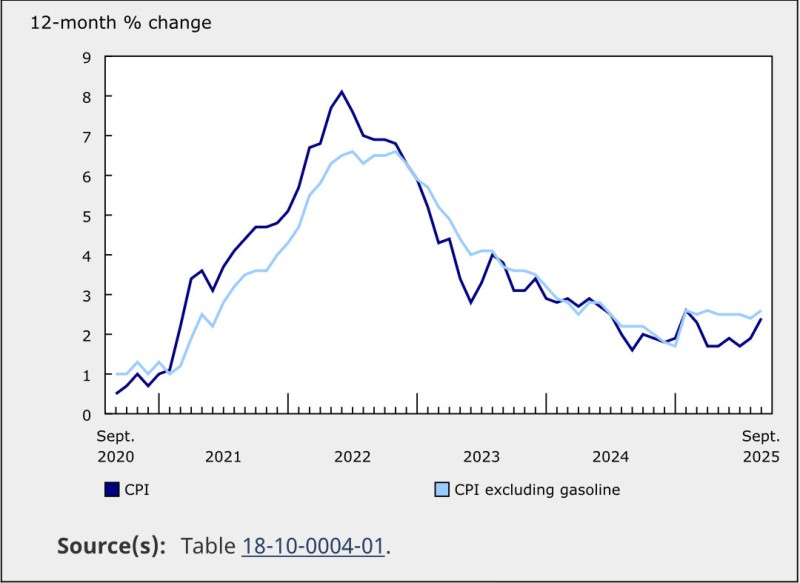

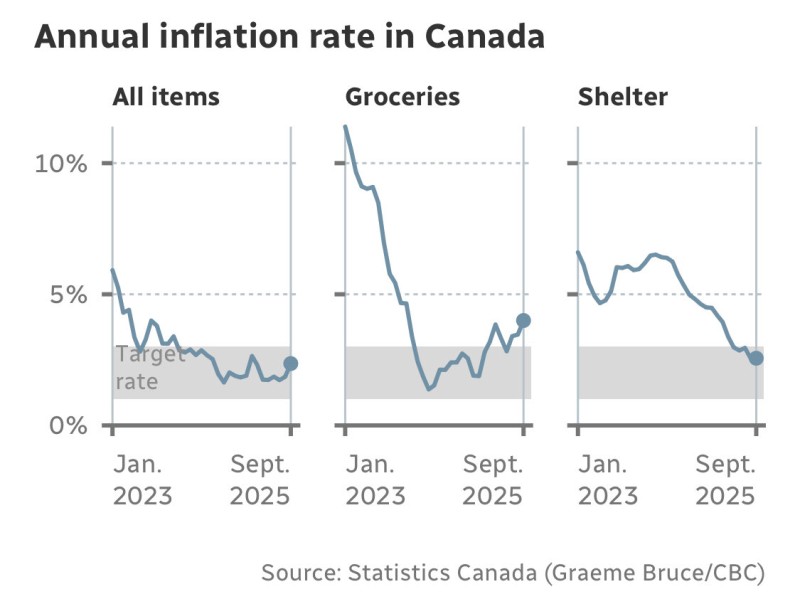

Food inflation is now outpacing overall consumer price growth, which had been hovering closer to the 2% target. The "Annual Inflation Rate in Canada" chart shows that while headline inflation cooled sharply from its 2022 peak above 8%, grocery prices have consistently stayed above 4%, resisting any full return to normal.

Gas and Rent Keep Pressure On

Gasoline prices ticked back up in late summer, reversing some of the earlier decline and adding to headline inflation. Shelter costs, though slightly softer recently, remain a major driver of core inflation, especially as urban rent prices continue climbing. The second chart, comparing CPI with and without gasoline, shows that even when fuel swings are stripped out, core inflation hasn't settled back to pre-pandemic levels. That points to deeper, structural cost pressures still working through the economy.

What It Means for Policy

The Bank of Canada has spent over two years tightening policy to wrestle inflation back to 2%, but September's numbers suggest price growth may be settling at a higher baseline than hoped. With headline inflation rising again and food costs staying sticky, economists expect the central bank to stay cautious before considering any rate cuts. For everyday Canadians, though, the picture is more immediate: budgets are still stretched thin by food, fuel, and rent, expenses that can't be easily trimmed.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi