Bitcoin (BTC) about to face its biggest test in months. With the Fed eyeing rate cuts and crucial inflation data dropping Tuesday, BTC traders are bracing for what could be a game-changing week.

Why BTC Is Following Wall Street's Rally

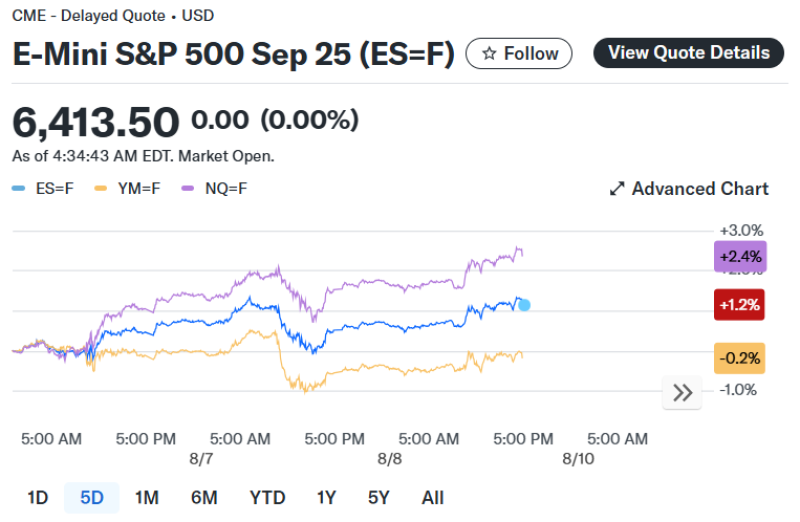

Last week was wild for traditional markets. The S&P 500 jumped 2.5%, the Nasdaq hit a fresh record with nearly 4% gains, and the Dow climbed 1.4%. Apple's massive $100 billion US investment got tech stocks pumping, and that energy usually spills into crypto.

Bitcoin (BTC) has been moving with tech stocks lately, especially during Fed policy uncertainty. With markets betting on several rate cuts this year, lower rates make Bitcoin more attractive since there's less opportunity cost versus holding cash.

Bitcoin (BTC) Faces Tuesday's Inflation Test

Tuesday's CPI report could be huge for Bitcoin (BTC). Economists expect headline inflation to hit 2.8% annually in July, up from June's 2.7%. Core inflation is projected at 3%, climbing from 2.9%.

If inflation stays high, it validates BTC's hedge narrative. But if numbers come in too hot, the Fed might delay rate cuts - bad news for crypto. Stephen Miran's nomination to replace Fed governor Adriana Kugler is making traders think cuts are coming sooner.

Fed Drama Could Boost Bitcoin (BTC) Prices

The Fed is basically split. Governors Chris Waller and Michelle Bowman have been dissenting on keeping rates steady. JPMorgan's Michael Feroli thinks if Miran gets approved by September, holding rates could lead to "at least three dissents" - pushing Powell toward cuts.

For Bitcoin (BTC), this Fed chaos could be perfect. When traditional monetary policy gets shaky, people look for alternatives. This week's wholesale inflation, retail sales, and consumer sentiment data could all move BTC markets, especially if they support the case for aggressive Fed action.

Peter Smith

Peter Smith

Peter Smith

Peter Smith