Here's what nobody's talking about: the US economy just hit an inflation speed bump that could send the dollar on a wild ride. While everyone's been focused on gas prices dropping, something bigger is brewing beneath the surface.

USD Faces Reality Check as Tariffs Bite

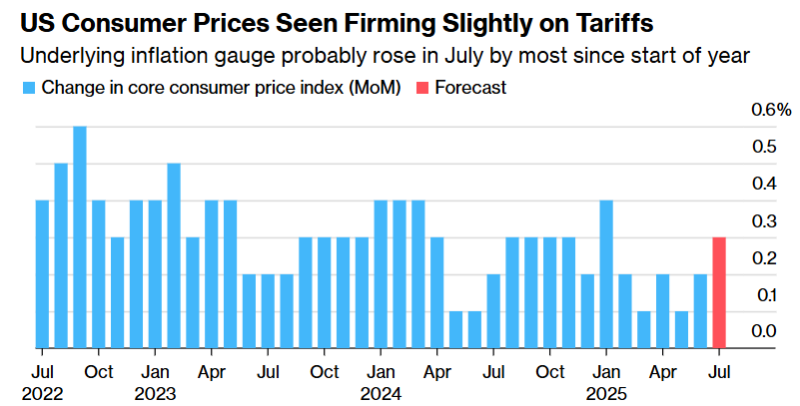

The numbers don't lie. Core inflation just jumped 0.3% in July - the biggest spike we've seen all year. That's a pretty dramatic shift from June's sleepy 0.2% rise, and it's happening for one simple reason: those tariffs everyone argued about are finally showing up in your shopping cart.

Think about it - when you're buying furniture or sports equipment, you're probably paying more without even realizing it. Companies have been quietly passing along those higher import costs, and now it's showing up in the official data. The only reason overall inflation looks tame at 0.2% is because gas got cheaper.

But here's where it gets interesting for USD traders. Usually, higher inflation would strengthen the dollar because everyone expects the Fed to raise rates. Not this time. Fed officials are basically sitting on their hands, trying to figure out if this tariff-driven price spike is here to stay or just a temporary headache.

Fed's Impossible Choice Could Tank USD

The Federal Reserve is stuck between a rock and a hard place right now. On one side, they've got inflation creeping higher thanks to tariffs. On the other side, the job market is starting to look shaky. That's not exactly the recipe for a strong currency.

Companies are getting creative about hiding price increases from customers because people just can't afford to pay more. Bloomberg's economists dropped a bombshell: real income actually went backwards in June. We're talking about income growth that's running at one-third of what it was during the pandemic boom.

This puts the dollar in a weird spot. Even with inflation rising, the Fed might not be able to do much about it without crushing an already fragile economy.

USD Price Prediction: Three Things to Watch

The next few weeks could be crucial for dollar direction. First up, that US-China trade deal expires Tuesday. If trade tensions flare up again, we could see more tariff pressure alongside safe-haven dollar buying - a messy combination.

Friday's retail sales data will tell us if consumers are actually spending despite higher prices. Early signs point to decent numbers thanks to car deals and Amazon's Prime Day, but strip out those price increases and the picture might look pretty ugly.

The real kicker? Manufacturing is already struggling with these tariff changes, and factory output looks set to stagnate. If this spreads to the broader economy while inflation keeps climbing, the Fed will face an impossible choice between fighting prices and supporting growth. That kind of uncertainty usually doesn't end well for currencies.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah