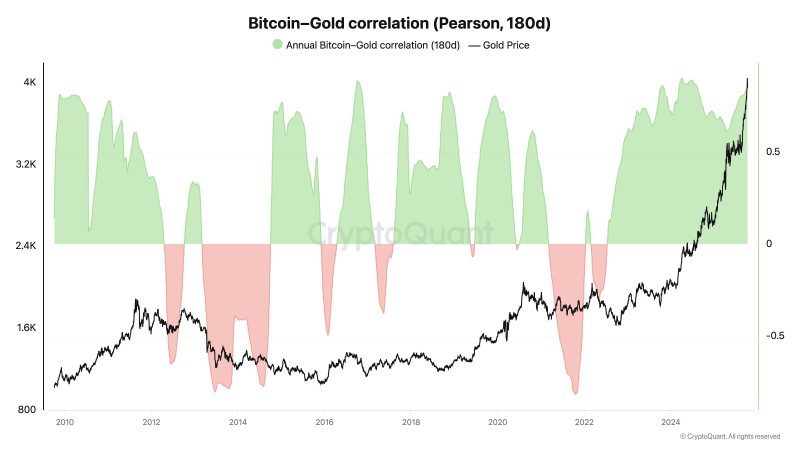

Gold's climb to record highs has gotten investors talking about safe-haven assets again. What's interesting is that Bitcoin has been moving more closely with gold lately, suggesting that the "digital gold" idea isn't just hype anymore.

What the Chart Shows

Analyst Ki Young Ju recently pointed out how this relationship might change how we think about Bitcoin's place in global markets, especially now that people are looking for better ways to protect themselves from inflation.

The data tracks how Bitcoin and gold have moved together over 180-day periods, and the pattern is revealing. When economic uncertainty picks up, both assets tend to attract money from investors looking for protection against inflation. But it hasn't always been this way. There have been times when Bitcoin went its own direction, acting more like a speculative tech stock than a defensive asset. Those periods usually lined up with crypto market booms and crashes that had little to do with gold.

Right now, we're seeing something different. The correlation is climbing back up just as gold pushes past $3,200 per ounce. This timing suggests Bitcoin is starting to fill a similar role as gold for some investors, even if it's doing so in its own volatile way.

Why This Matters

A few things are driving this shift. Inflation hasn't gone away, and people are putting money into hard assets that can't be printed endlessly by central banks. Gold has always been the go-to option here, but Bitcoin's fixed supply of 21 million coins is making it look attractive too. More institutional investors are taking Bitcoin seriously now, which wasn't true a few years ago. And for people building investment portfolios, holding both gold and Bitcoin might offer better protection than either one alone.

If gold keeps climbing and Bitcoin maintains this correlation, we could see them move together through whatever economic turbulence comes next. Bitcoin is still much more volatile than gold, but the "digital gold" story is clearly resonating with more investors than before.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah