The Japanese yen continues to lose ground on a broad basis, raising questions about how much further it can fall. With the trade-weighted index already sitting near multi-year lows, analysts are watching to see if 2025 will bring another leg down—even as the dollar itself struggles to gain traction.

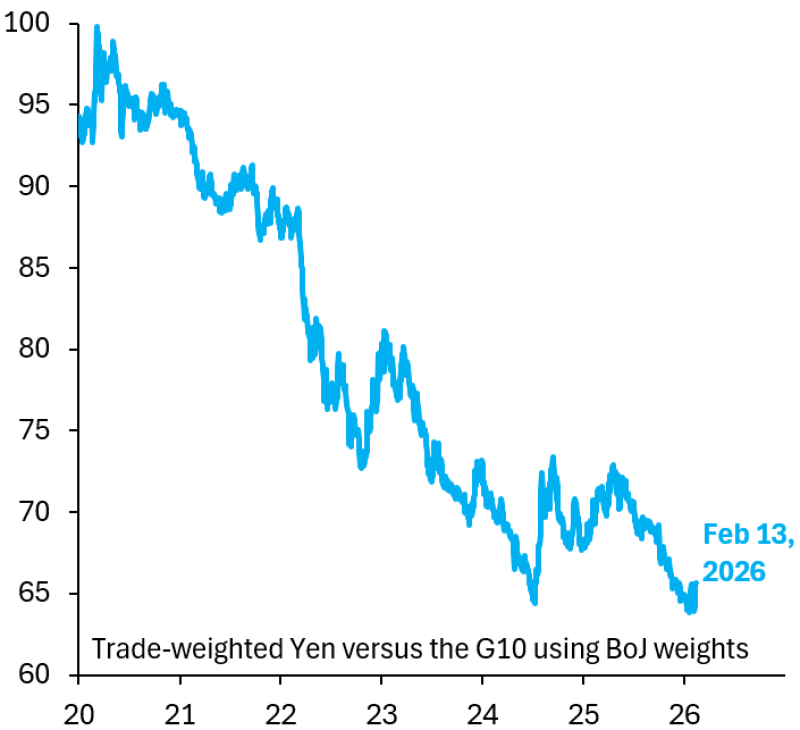

Trade-Weighted JPY Index Trends Lower Versus G10

The Japanese yen is on track to weaken further on a trade-weighted basis and may carve out new lows this year, according to Robin Brooks. A chart showing the trade-weighted yen versus the G10 using Bank of Japan weights reveals a steady decline from close to 100 in 2020 down to the mid-60s by February 13, 2026. That multi-year slide highlights broad-based depreciation rather than weakness against just one currency.

The trade-weighted framework is important because it captures how the yen is performing against all major trading partners, not simply the dollar. This gives a clearer picture of overall currency strength—or in this case, persistent weakness.

Fiscal Pressure and the "Double Whammy" Scenario

One of the key drivers behind the yen's troubles is Japan's massive debt load and what some see as a lack of urgency in tackling the necessary adjustments. As Brooks noted, the scale of Japan's fiscal challenge hasn't been fully priced in by markets yet.

But there's another layer to the story. The yen is caught in what's being called a "double whammy": falling even when the U.S. dollar is also declining. That means the yen is underperforming against multiple currencies at once, not just riding the coattails of dollar strength. For more on recent yen moves, see Japanese Yen Drops to 8-Month Low Against Dollar and USD/JPY Hits 158.8: Japanese Yen Slides to 18-Month Low.

What New Lows in 2025 Would Mean

With the trade-weighted yen already sitting at depressed levels, the big question for 2025 is whether structural issues and shifting FX dynamics will keep pushing it lower across the G10 basket. If new lows do arrive as expected, it would confirm a broader theme: currency weakness can stick around even when the dollar isn't rallying. Additional context on policy divergence can be found in UK Gilt Yields Hit 4% While BoJ Caps Keep JGB Rates at 2%.

The outlook for Japan's currency remains tilted to the downside as long as fiscal concerns linger and the yen continues to lose ground on multiple fronts.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah