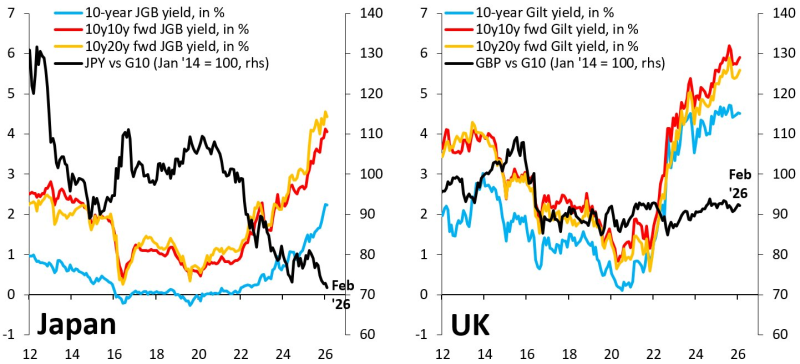

⬤ Bond markets in the UK and Japan have taken dramatically different paths in recent years. As Robin Brooks pointed out, the UK allowed government bond yields to rise following its 2022 fiscal crisis, while the Bank of Japan kept capping Japanese government bond yields—a policy split that's now showing up clearly in currency markets.

⬤ The data tells a compelling story. UK 10-year gilt yields climbed sharply to above 4 percent by early 2026, with forward yield expectations rising in tandem. During this same period, the pound stabilized against G10 currencies. Meanwhile, Japan's 10-year JGB yield stayed suppressed for years, only nudging moderately higher to around 2 percent, as the yen weakened broadly. Similar patterns were observed in yen weakness against major currencies.

⬤ Forward yield curves highlight the stark contrast between these two approaches. UK forward yields trend upward alongside spot yields, reflecting market expectations of continued tightening. Japan's forward path remains notably flatter due to ongoing yield caps. As the Economist observed, "The difference between flexible yields and controlled yields" demonstrates how policy frameworks directly shape currency direction - a dynamic explored further in bond yield divergence impact on FX markets.

⬤ This comparison reveals how bond market structure directly influences exchange rate direction. Diverging interest rate frameworks will continue shaping currency trends across developed economies as long as Japan maintains its yield control policy. The pound's stabilization versus the yen's persistent weakness underscores a fundamental truth: central bank policy choices on bond yields create real consequences in forex markets.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah