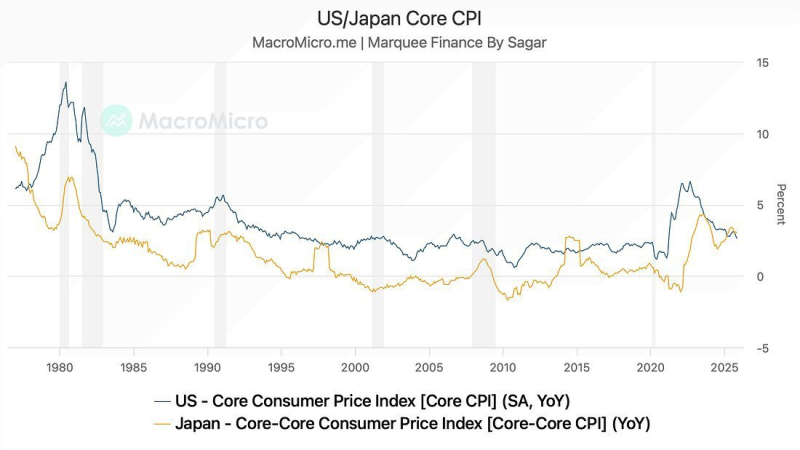

⬤ Something remarkable just happened in global inflation dynamics. Japan's core inflation has climbed above America's for the first time since 1979. The data shows Japan's Core Core CPI crossing above U.S. Core CPI in recent months, ending a 45-year streak where American inflation consistently ran hotter than Japan's.

⬤ Looking at the long-term picture, the contrast is striking. U.S. inflation has been on a roller coaster since the late 1970s—spiking in the early 1980s, staying elevated through various cycles, then surging again after 2020. Japan, meanwhile, spent nearly three decades fighting the opposite problem. Their inflation barely budged, often sitting near zero as deflation became the bigger concern.

This marks a rare reversal following decades in which inflation in the United States consistently exceeded that of Japan, highlighting just how unusual this moment is.

⬤ What's driving this flip? U.S. inflation is cooling down from its post-pandemic peak, while Japan's price pressures are holding steady. The gap narrowed gradually before finally crossing over. It's not that Japan suddenly experienced runaway inflation—it's more about two economies moving in opposite directions at the same time.

⬤ Inflation gaps between countries directly influence central bank decisions, currency movements, and where money flows globally. For decades, everyone assumed Japan would struggle with weak prices. Now that assumption is being challenged. If this trend continues, it reshapes how investors think about Japanese assets, monetary policy paths, and the broader macro landscape.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi