Smart Money Technique (SMT) divergence between correlated currency pairs can reveal important clues about market direction. When two pairs that typically move together start diverging, it often signals that institutional players are positioning for a reversal or liquidity grab.

Divergence in Action

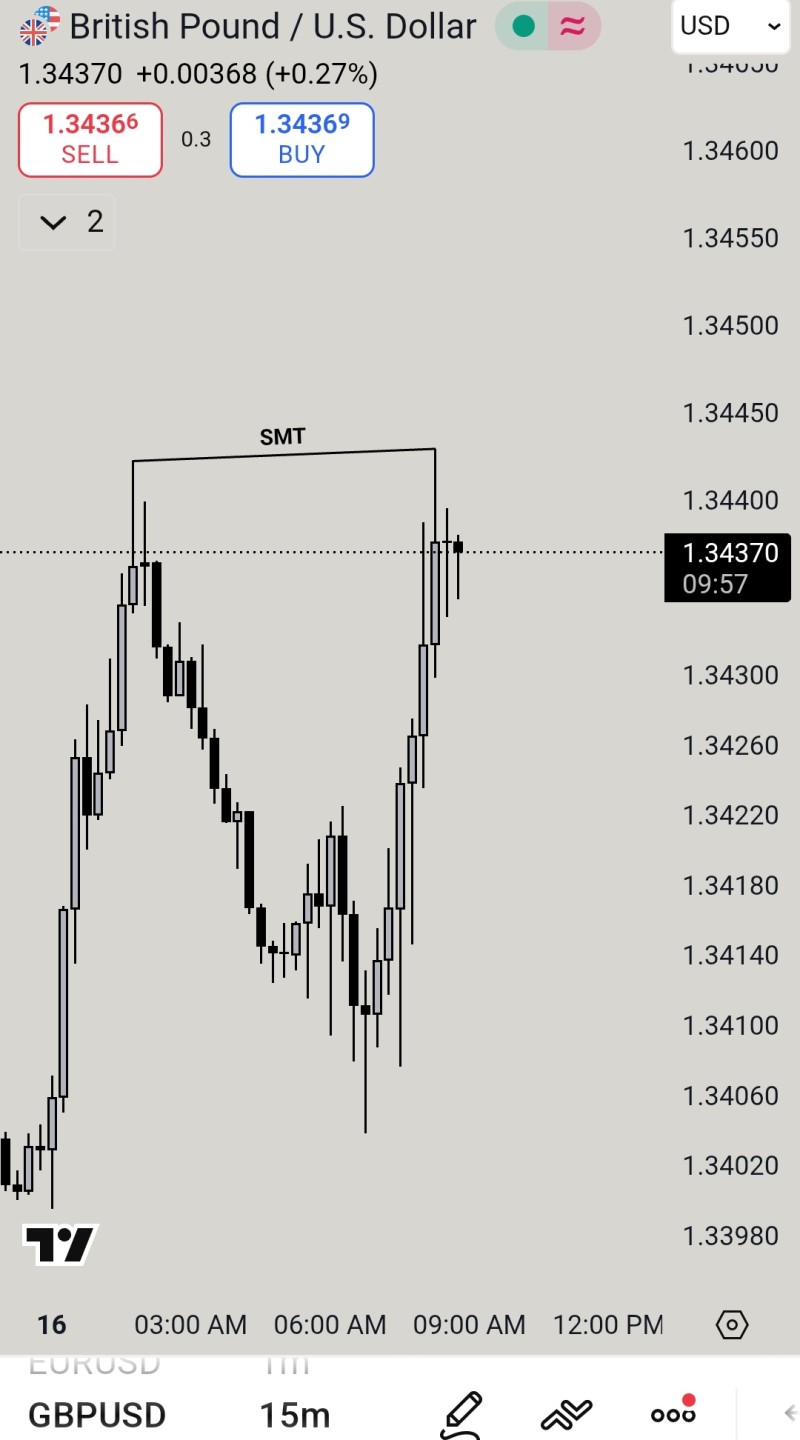

Trader Mahedi Hasan recently highlighted an SMT divergence between GBP/USD and EUR/USD.

This pattern emerges when two strongly correlated pairs move in opposite directions, which can indicate manipulation or hidden liquidity plays by smart money.

The recent price action shows this divergence clearly. GBP/USD pushed higher to 1.3440, forming a temporary top, while EUR/USD stayed subdued, respecting a descending trendline around 1.1670.

This mismatch is textbook divergence behavior and typically comes before a shift in short-term momentum.

What the Charts Tell Us

Looking at the 15-minute GBP/USD chart, the pair broke above previous highs around 1.3440 before stalling. These types of moves often represent stop-hunting activity where price spikes to grab liquidity before reversing. Meanwhile, the EUR/USD chart tells a different story. Rather than confirming the bullish push, EUR/USD consolidated under its trendline, showing relative weakness compared to its British counterpart.

This SMT divergence suggests smart money might be engineering liquidity plays, with GBP/USD temporarily overextended while EUR/USD lags behind. When correlated pairs behave this differently, one is usually showing the real direction before the other catches up.

Broader Market Forces

Several factors are driving this divergence:

- U.S. dollar strength remains dominant due to Federal Reserve policy expectations and incoming macro data

- Persistent Eurozone economic weakness continues pressuring EUR/USD lower

- Relative GBP resilience, backed by stronger UK economic reports, helped push the pound higher in the near term

Key Levels to Monitor

If GBP/USD can't hold above 1.3440, a pullback toward 1.3400 becomes likely. On the euro side, EUR/USD might attempt a bounce if dollar pressure eases, with 1.1680 serving as the first resistance to watch.

For traders, this SMT divergence serves as a reminder to keep an eye on correlated pairs. Often one will telegraph the true market direction before the other follows suit.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah