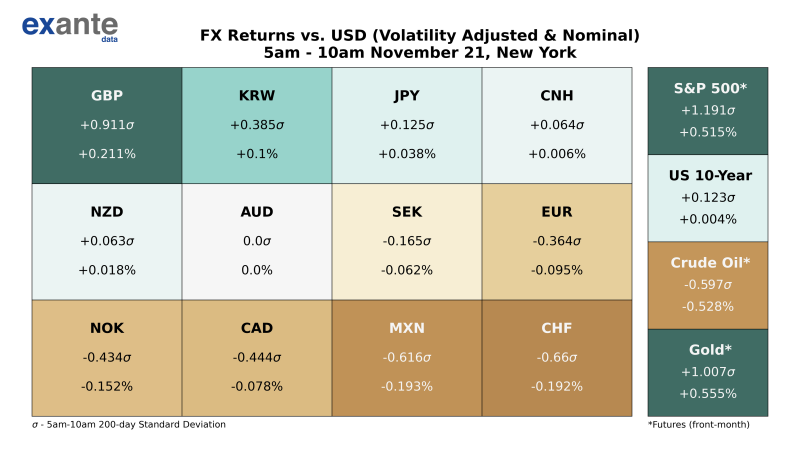

⬤ The dollar had a pretty mixed morning on Thursday during the early New York session, with currencies moving in different directions across the board. The British pound came out on top between 5am and 10am, while the Swiss franc took the biggest hit against the greenback. These moves show how short-term currency markets are being shaped by regional flows and what happened overnight.

⬤ Looking at the numbers, the GBP climbed about 0.21 percent versus the dollar, backed by a solid volatility-adjusted gain of +0.911σ. The South Korean won also moved higher, up 0.1 percent, while the Japanese yen and Chinese yuan barely budged—gaining just 0.038 percent and 0.006 percent respectively. On the flip side, the Swiss franc got hammered, dropping around 0.19 percent to become the session's worst performer with a volatility reading of −0.66σ. The euro also slipped a bit, down about 0.095 percent, along with weakness in the Swedish krona and some commodity currencies.

⬤ The rest of the FX market was all over the place. The Aussie dollar stayed flat while the Kiwi managed a tiny 0.018 percent gain. Meanwhile, the Norwegian krone, Canadian dollar, and Mexican peso all lost ground against the dollar, with the peso taking the biggest hit at nearly 0.193 percent down.

The GBP rose approximately 0.21 percent versus the $USD, supported by a volatility-adjusted gain of +0.911σ

⬤ Outside currencies, equity futures were looking better—S&P 500 futures jumped 0.515 percent and gold futures gained 0.555 percent. But crude oil futures dropped more than half a percent, which helped drive some of the dollar's moves during the morning window.

⬤ The all-over-the-map performance really shows investors are being cautious right now, trying to balance stronger stock futures against weaker commodity prices. With different regions pulling in different directions, this mixed dollar performance is creating a pretty fluid trading environment. Everyone's waiting on upcoming US economic data and global policy news, which will probably drive volatility and shape how traders position themselves for the rest of the day.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi