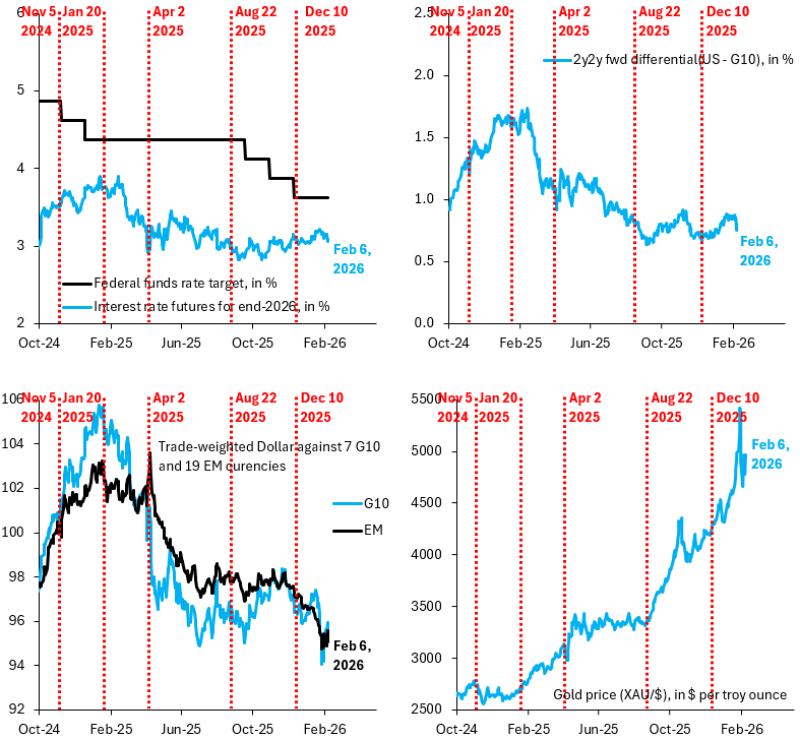

⬤ A softer US dollar is grabbing attention again out that a falling greenback has historically meant easier financial conditions. The multi-panel chart ties the trade-weighted dollar's slide to changing rate expectations and shifting relative rate dynamics, painting a macro picture where dollar weakness can run alongside broader support for risk. Related tracking of the dollar's downward push has been covered in U.S. Dollar Index falls below March 2022 low after 13% decline.

⬤ The chart shows several pieces moving in sync: a dropping federal funds rate target path, a tightening 2y2y forward spread between the US and G10, and a trade-weighted dollar sliding versus both G10 and emerging market baskets. In this view, the mix reflects loosening financial conditions, which has historically lifted risk assets, improved multinationals' earnings, and given a boost to emerging markets and commodities. The broader connection between rates and the dollar is also examined in Fed rate cut signals dollar weakness: DXY at risk.

⬤ The main conditional point centers on the signal from macro data. The chart highlights the dollar and rate direction as the engine, rather than pinning the result on any single market. Other coverage linking evolving rate expectations to market shifts includes U.S. job openings drop to 0.87 per worker as 2026 rate cut expectations build.

⬤ The bottom line is that USD movement is being watched as a gauge of financial conditions. If the dollar keeps weakening under the right conditions, it would fit the historical pattern where easier conditions align with stronger performance across risk assets.

Usman Salis

Usman Salis

Usman Salis

Usman Salis