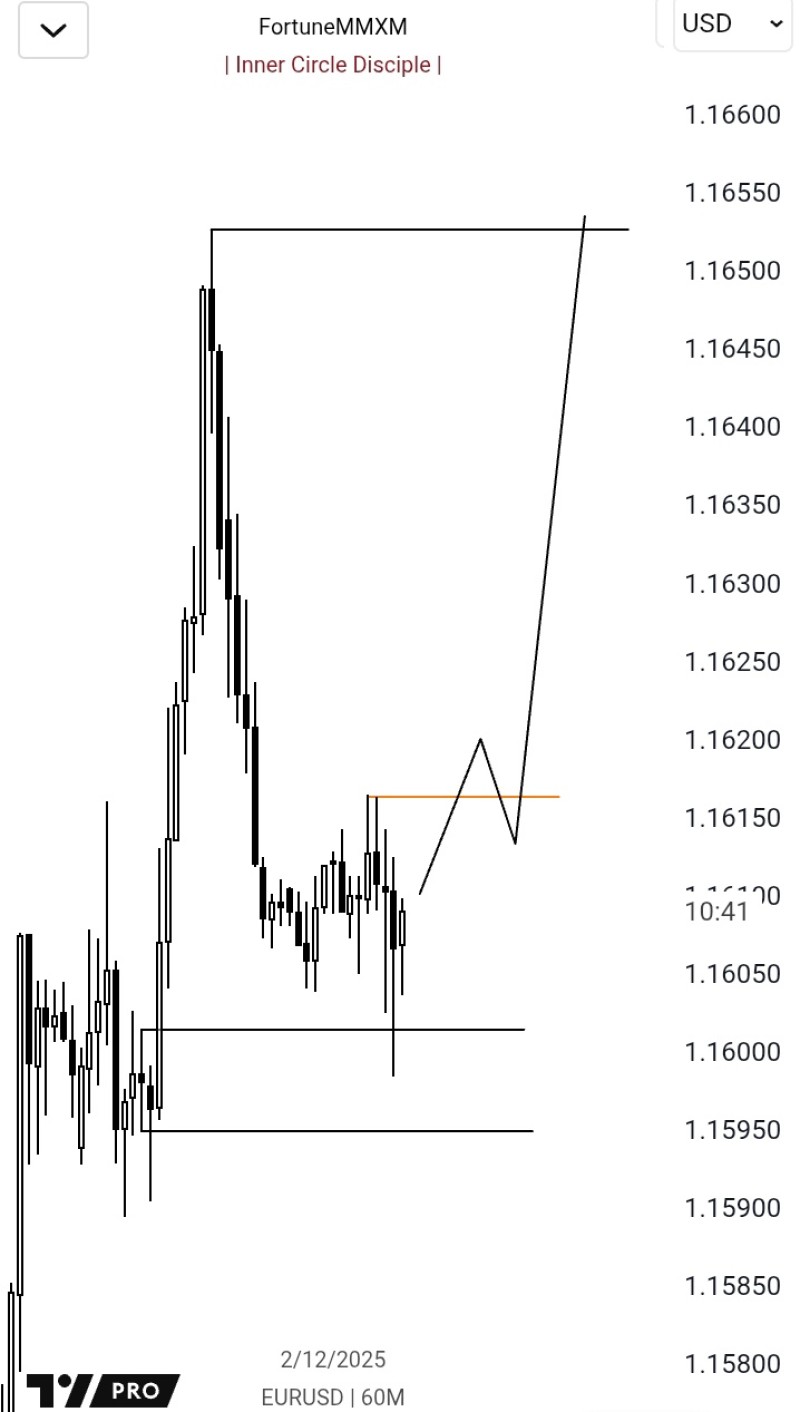

⬤ EUR/USD has been trading in a tight range on the 60-minute chart, with immediate direction tied to a key resistance line. A close above the 1.1615 yellow level would open the door for further gains. Price is currently moving sideways after recent volatility, sitting just below this decision point that's acting as the near-term barrier.

⬤ The current pattern shows controlled buying interest, with EUR/USD repeatedly finding support around 1.1600. Multiple lower wicks near that level point to solid demand. The yellow horizontal marker represents the local resistance zone the pair needs to break through for confirmation of upward momentum. The projected path suggests a brief dip back into this level before a potential push higher toward 1.1650–1.1660, which becomes more likely once price closes above the line.

⬤ Despite the constructive setup, directional bias still needs near-term confirmation. EUR/USD hasn't made a decisive break above resistance yet, but the chart structure hints at renewed bullish activity if price holds above 1.1615. On the flip side, failure to maintain pressure at this level could trap the pair in its current range, with lower support zones near 1.1590 acting as potential bounce areas. Price action remains tightly bound by these intraday levels.

⬤ This setup carries weight because EUR/USD is sitting at a threshold where small shifts in buying or selling pressure can swing near-term direction. A sustained break above resistance may signal building momentum and renewed stability after recent swings. Failure to reclaim the level, though, might point to fading short-term strength. The next hourly close will be crucial in shaping where EUR/USD heads next.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir