The EUR/USD daily chart is displaying a potential downside shift as price action rejects key resistance and develops patterns that suggest sellers may gain control in the short term. This analysis examines the technical setup and fundamental drivers pointing toward lower price targets.

EUR/USD Technical Picture

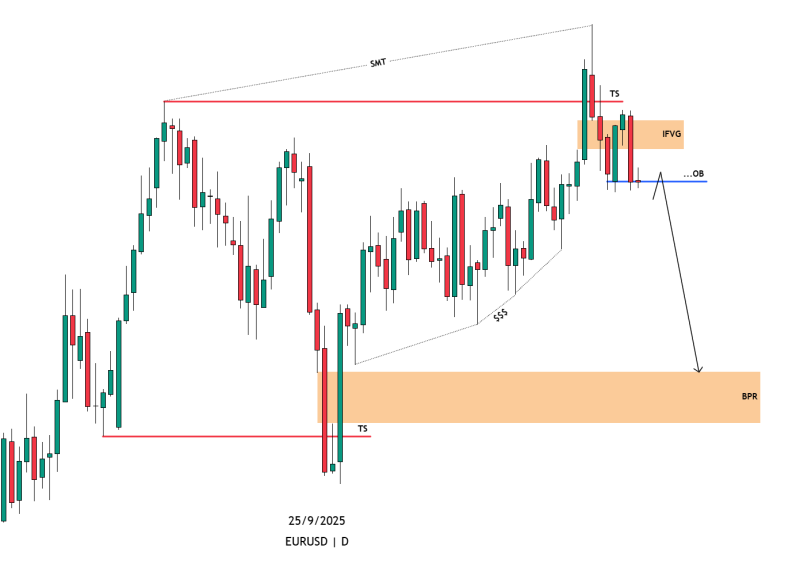

As noted by trader SIRRILLAH, the EUR/USD recently formed a Swing Market Top (SMT) before declining.

A Trend Shift (TS) occurred following rejection at resistance, with price now consolidating within an Imbalance Fair Value Gap (IFVG). Below current market levels, a crucial Order Block (OB) acts as short-term support. A break below this zone would likely confirm bearish continuation toward the Bullish Price Range (BPR), where buyers might attempt to enter.

The setup shows a clear rejection from the highs marking a loss of bullish momentum. Price is reacting to the IFVG inefficiency, indicating unresolved selling pressure, while the Order Block test represents a critical juncture. A failure to defend this level would open the door to deeper declines. This confluence suggests the path of least resistance is downward unless buyers reclaim the OB with strong conviction.

Fundamental Drivers

Beyond the technical picture, macroeconomic forces continue pressuring the euro. Diverging monetary policy between the Federal Reserve and European Central Bank, combined with weak eurozone growth data, are weighing on EUR/USD. Upcoming U.S. economic releases may further reinforce dollar strength and add to the bearish case.

Testing Lower Demand

EUR/USD stands at a critical turning point. If the OB fails, price could decline into the highlighted BPR support zone, aligning with the bearish projection. Conversely, a sharp recovery above the IFVG would weaken the downside scenario and reintroduce bullish potential. For now, the technical landscape favors sellers, with EUR/USD vulnerable to testing deeper support levels before any meaningful recovery attempt materializes.

Peter Smith

Peter Smith

Peter Smith

Peter Smith