EUR/USD is holding a bullish tone on the hourly chart, defending intraday support near 1.1730–1.1740. Traders are watching closely to see if momentum can push toward the liquidity zone above 1.1770.

Strong Technical Structure in Play

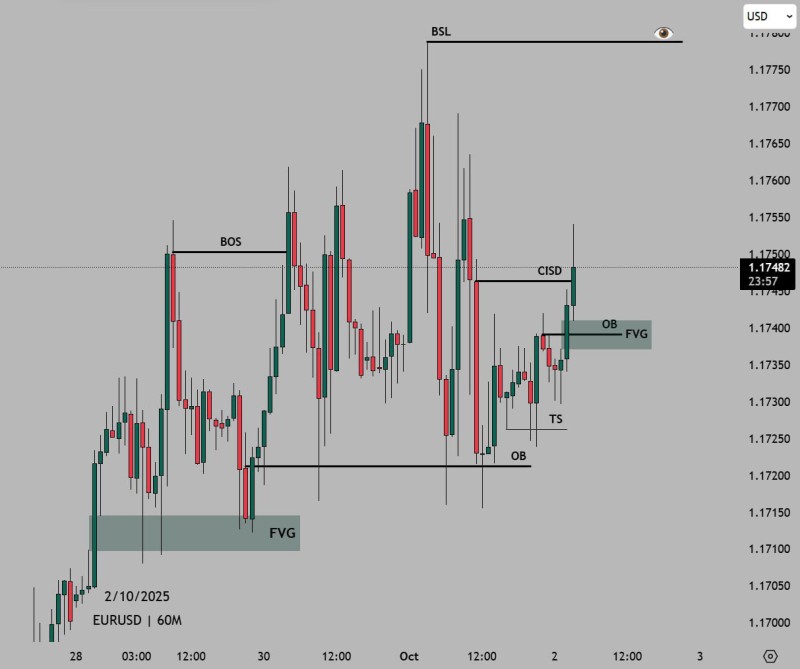

The pair continues to respect a bullish market structure despite recent volatility. As trader Dayyib Sanka points out, the bullish bias remains valid as long as price closes above the CISD (Current Intraday Structural Demand) area.

Several key signals are worth noting: buyers confirmed upward momentum with a Break of Structure (BOS) that pushed price into the mid-1.1740s, rebounds from order block demand zones near 1.1720 reinforce buyer activity, the Fair Value Gap between 1.1730–1.1740 has been tapped and held suggesting liquidity has been balanced with bullish intent, and the next major upside target sits near the Buy-Side Liquidity at 1.1770 where stop orders could fuel additional gains.

Macro Drivers Behind the Move

Beyond the technicals, euro strength is being supported by eurozone inflation data coming in above expectations, while the dollar faces pressure from speculation that the Federal Reserve might pause rate hikes soon. This macro backdrop adds weight to the bullish case for the pair.

What Comes Next

As long as EUR/USD trades above the 1.1730–1.1740 support, buyers are likely to stay in control. A sustained close above CISD could accelerate price action toward 1.1770. However, if this area fails to hold, the pair would be exposed to a retest of the 1.1720 zone. The market structure currently favors buyers, though volatility around U.S. economic releases could quickly shift this outlook.

Usman Salis

Usman Salis

Usman Salis

Usman Salis