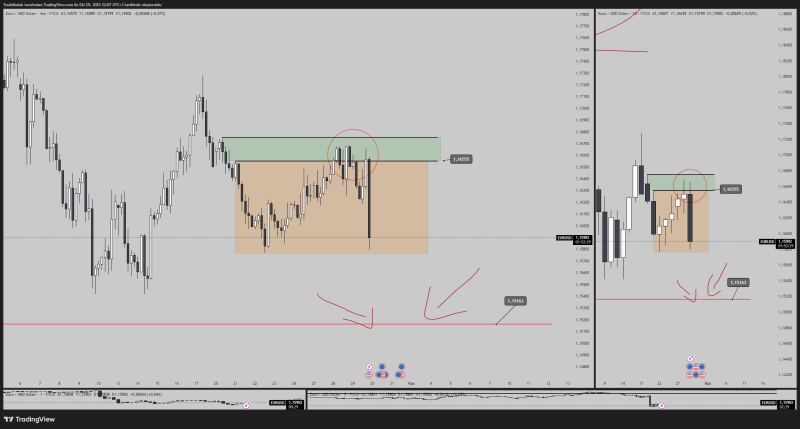

● The EUR/USD pair played out exactly as expected. The euro got rejected hard at the 1.1619–1.1655 supply zone, proving that sellers are firmly in control at that level. All open positions have been closed, and the focus now shifts to what happens next—either a retest of the same zone or a drop to 1.1516.

● The failure to push past 1.16 is a clear short-term rejection. Multiple attempts to break higher were shut down, followed by a sharp bearish move—classic signs of supply overwhelming demand. The market has spoken: sellers aren't letting go of this level easily.

● The euro obeyed the plan; no move higher until 1.15163 is taken. Translation: until the pair dips below that support level, bulls should stay on the sidelines. The next few sessions will likely center on how price reacts near 1.1516, where buyers might step back in and reset the structure.

● Behind the technicals, macro factors are at play too. A strong U.S. dollar, backed by higher yields, continues weighing on the euro. Traders are also waiting for fresh signals from central banks and upcoming inflation prints.

● While the near-term bias leans bearish, a bounce could be in the cards once 1.1516 gets tested and holds. New setups will come once the price reaches the 1.1619 supply zone again, meaning the 1.1516–1.1619 range will define the next trade opportunities.

Usman Salis

Usman Salis

Usman Salis

Usman Salis