EUR/USD is showing weakness on lower timeframes as it enters a critical supply zone that could spark a near-term pullback. The pair has reached a fair value gap that may trigger selling pressure in the coming sessions.

Technical Setup: Fair Value Gap and Supply Zone Confluence

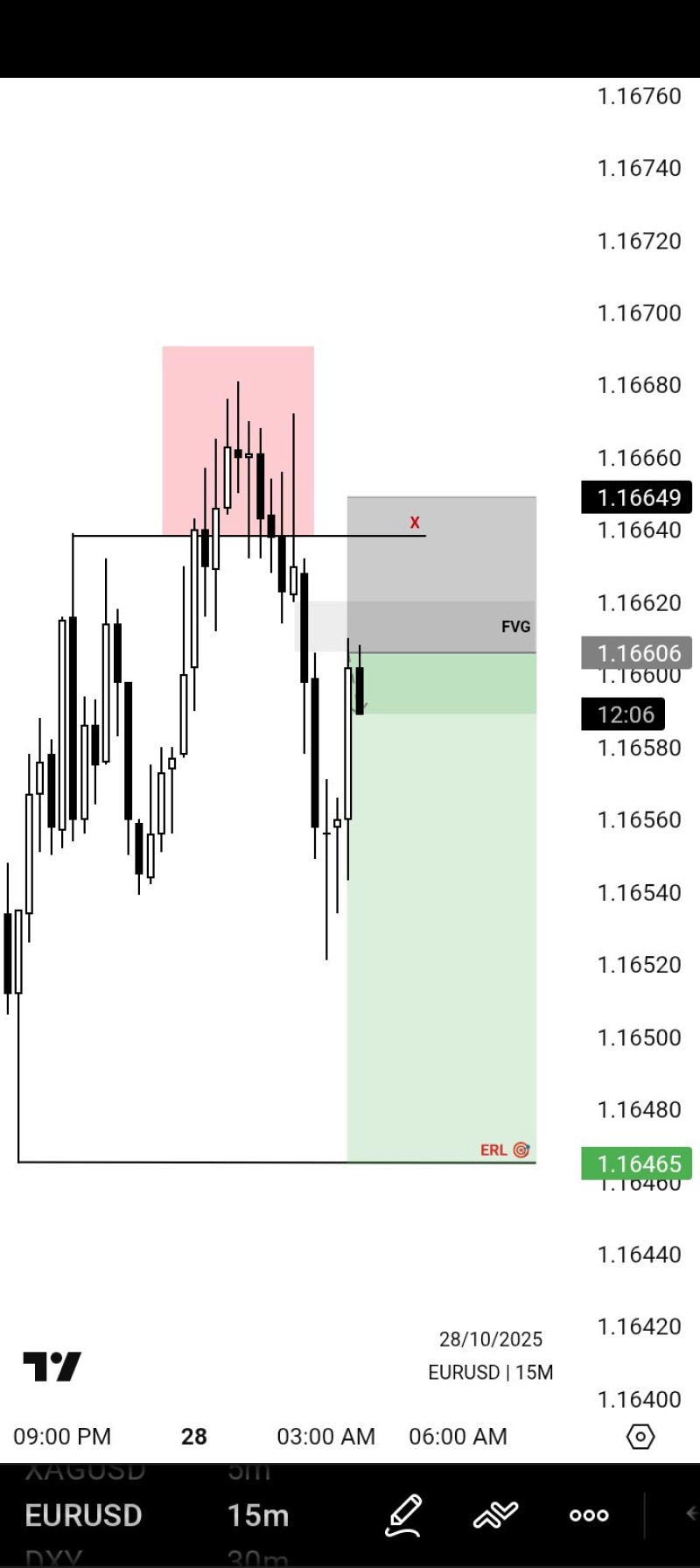

According to forex trader MR | EUR, who specializes in liquidity-based setups, the chart reveals EUR/USD trading around 1.1660–1.1665, where it recently tapped into a fair value gap—a region typically filled with unfilled orders and short-term inefficiencies. The red zone above 1.1665 marks a supply area where previous sell orders dominated, hinting at possible rejection pressure ahead.

Recent price action shows a failed push above 1.1665, followed by smaller bearish candles forming near the FVG's upper boundary. This pattern signals early exhaustion among buyers and supports the case for a short pullback toward 1.1645, which corresponds to the ERL target zone highlighted in green. The setup offers a tight stop-loss above 1.1665 and a target near 1.1645, creating an attractive risk-to-reward profile if the market responds as anticipated.

Market Context: Reaction to Liquidity and Order Flow

The current structure suggests EUR/USD has hit a liquidity pocket, triggering typical institutional order flow rebalancing. After filling the imbalance and meeting previous highs, selling momentum has started to resurface. Macro factors also support a cautious stance—traders are eyeing upcoming U.S. GDP data and ECB policy remarks, which could inject volatility and boost the dollar's short-term appeal. Until then, EUR/USD remains vulnerable to intraday liquidity grabs and technical rejections within the 1.1660–1.1670 band.

Watching 1.1665 for Confirmation

If EUR/USD keeps rejecting the FVG area and closes below 1.1660, it would strengthen the bearish case. The immediate support around 1.1645 serves as a near-term target, with further downside possible if macro catalysts align. On the flip side, a decisive close above 1.1670 would void the current sell setup and potentially open the path toward 1.1700, where resting liquidity from earlier sessions remains visible. For now, confirmation candles near the FVG rejection zone will be key in determining whether the pair extends lower or stabilizes before the next macro-driven shift.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir