The EUR/USD pair is at a critical juncture as it tests key support levels while displaying encouraging technical patterns that could signal a shift in momentum for the coming sessions.

EUR/USD Finds Its Footing at Key Support

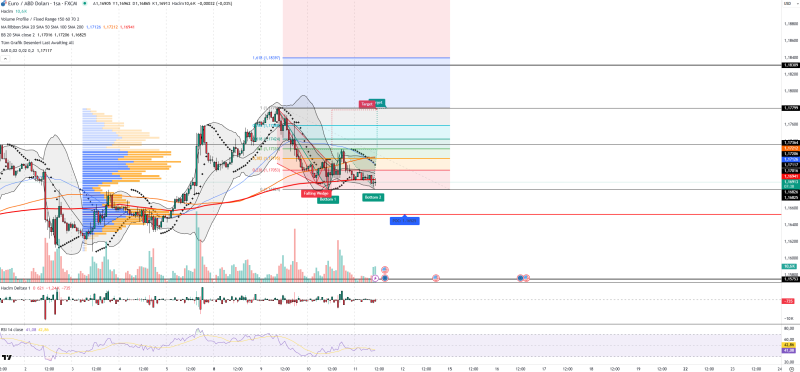

The hourly chart tells an interesting story right now. EUR/USD is camping out near 1.1680, a level that's proven its worth as solid support. What's catching traders' attention is the double bottom that's forming here, paired with a falling wedge - both classic signs that bulls might be ready to make their move.

Sure, the euro took a hit below 1.1700, but buyers aren't giving up without a fight. Analyst Forex Sinyal Merkezi notes that while the euro slipped below this level, buyers are attempting to defend the 1.1680 zone. They're digging in at this support, and if they can push back above those short-term moving averages, we could see some real momentum building.

What the Charts Are Saying

The technical picture is getting more interesting by the hour:

- Double bottom plus falling wedge: Two bullish patterns stacking up, but they need a clean breakout to really matter

- Moving average resistance: The 100-hour SMA sits at 1.1721 and the 200-hour at 1.1712 - break above these and things get exciting

- Fibonacci roadmap: First stop would be 1.1705, then 1.1731, with 1.1742 as the bigger target

- Volume tells the story: Point of Control at 1.1652 is the line in the sand for long-term support

The indicators are painting a mixed but hopeful picture. RSI at 41 is flirting with oversold territory, which often sparks rebounds. Price is hugging the lower Bollinger Band - another bounce signal. The Parabolic SAR is still bearish short-term, but that could flip quickly with the right momentum.

The macro story is what really matters here. ECB rate cut chatter keeps weighing on the euro, while the dollar stays strong thanks to the Fed's tough talk and solid US data. Keep an eye on upcoming Eurozone growth numbers and US inflation figures - they could be the catalysts that break this range either way.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah