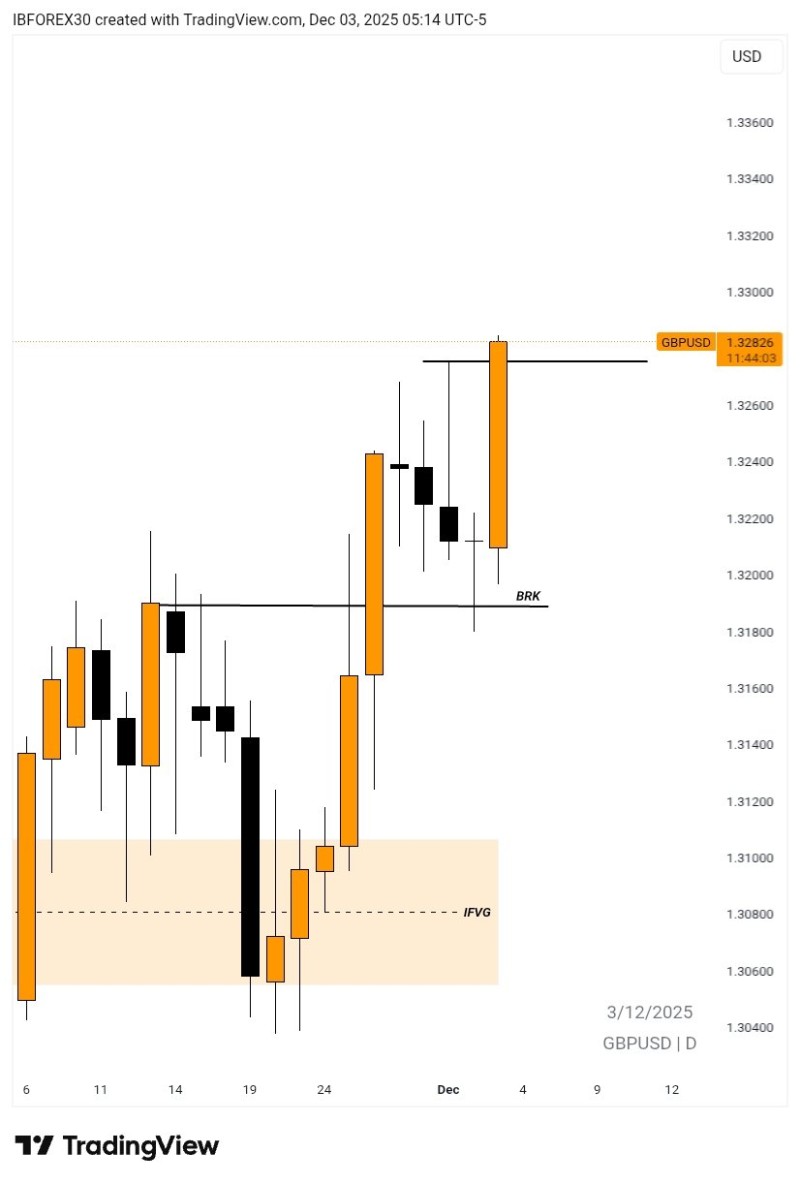

⬤ EUR/USD climbed toward an important technical level on Tuesday, continuing its upward push after several sessions of consistent gains. The key question now is whether the current daily candle can close above its recent high—a move that would point to a bullish outlook for the following day. The chart reveals a strong upward candle breaking above the previous structure marked as BRK, showing fresh buying interest around the upper edge of the short-term range.

⬤ The setup shows a clear upward movement from the imbalance zone labeled IFVG, where EUR/USD had consolidated before gaining speed. Recent candles demonstrate buyers taking charge, creating a series of higher closes as the pair pulled away from mid-range support. The latest bullish candle is notable for its solid body and small lower wick, pointing to strong demand as price neared the prior high. A confirmed close above that level would represent a meaningful change in short-term direction.

⬤ The chart also shows how EUR/USD responded to earlier structural points, with the BRK level serving as a midpoint reference before the current rally. Price action above this area suggests building momentum, though the pair stays below the broader upper range from earlier this month. The focus is on whether EUR/USD can hold near the session high as the daily close approaches. A pullback at this level would keep the pair within its current range, while a strong close could confirm the shift in intraday sentiment and encourage further upside movement in the near term.

Peter Smith

Peter Smith

Peter Smith

Peter Smith