Sometimes the forex market throws you a curveball that makes even seasoned traders pause. That's exactly what's happening with EUR/USD right now. After clearing both sides of its recent range, the pair has created the kind of technical mess that separates the pros from the amateurs.

When a currency pair takes out both buy-side and sell-side liquidity in quick succession, it's like watching a poker player go all-in on two different hands simultaneously. The market has essentially hedged its bets, leaving everyone wondering which direction has the real momentum.

EUR/USD Price Action Signals High Uncertainty

Here's where things get interesting. Trader @sirrillahfx has been tracking this setup, and what he's seeing isn't pretty for anyone looking for a clean trade.

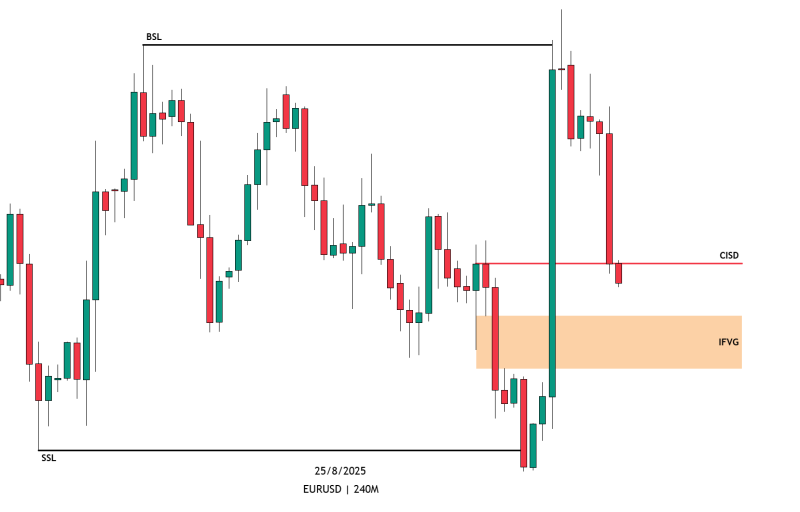

The pair just pulled off what technical analysts call a "double sweep" – it pushed high enough to grab all the buy orders sitting above the range, then immediately reversed to flush out the stop losses below. It's like the market is playing both sides against the middle.

This kind of action usually happens when big players are repositioning, but it leaves retail traders holding the bag. The IFVG zone that looked so promising for long positions? Well, it's still there, but now it comes with a giant question mark attached.

Technical Outlook for EUR/USD Price

Looking at the charts, EUR/USD is stuck in no man's land between 1.1690 and 1.1770. The CISD level around 1.1720-1.1740 has become the line in the sand that everyone's watching.

Here's the brutal truth: both the bullish and bearish scenarios have already played out partially. The buy-side liquidity grab should have been rocket fuel for bulls, but instead, we got a fake-out. The sell-side sweep should have opened the floodgates for bears, but that didn't stick either.

The IFVG zone is still on the radar, but betting on it now feels like trying to catch a falling knife while riding a unicycle. Possible? Sure. Advisable? That's another story.

What's Next for EUR/USD (EURUSD)?

With both liquidity pools drained, EUR/USD might just sit in timeout for a while. The market has basically cleared its throat and now needs to figure out what it actually wants to say.

Smart money is probably waiting for one of two things: either a convincing break back above 1.1770 that actually holds this time, or a real breakdown below 1.1690 that doesn't immediately snap back.

The CISD level is where the action will likely unfold. Hold above it, and bulls might get a second chance. Lose it convincingly, and we could see that deeper pullback everyone's been talking about.

Bottom line? This isn't the time to be a hero. The market just showed it's willing to fake out both sides, which means the next move could be equally deceptive. Sometimes the best trade is no trade, and EUR/USD might be serving up exactly that kind of lesson right now.

Usman Salis

Usman Salis

Usman Salis

Usman Salis