The EUR/USD pair has delivered an explosive performance that's caught the attention of traders worldwide. After weeks of consolidation and mixed signals, the currency pair has finally shown its hand with a decisive move that could reshape the medium-term outlook for this major forex pair.

EUR/USD Crushes Resistance in Textbook Fashion

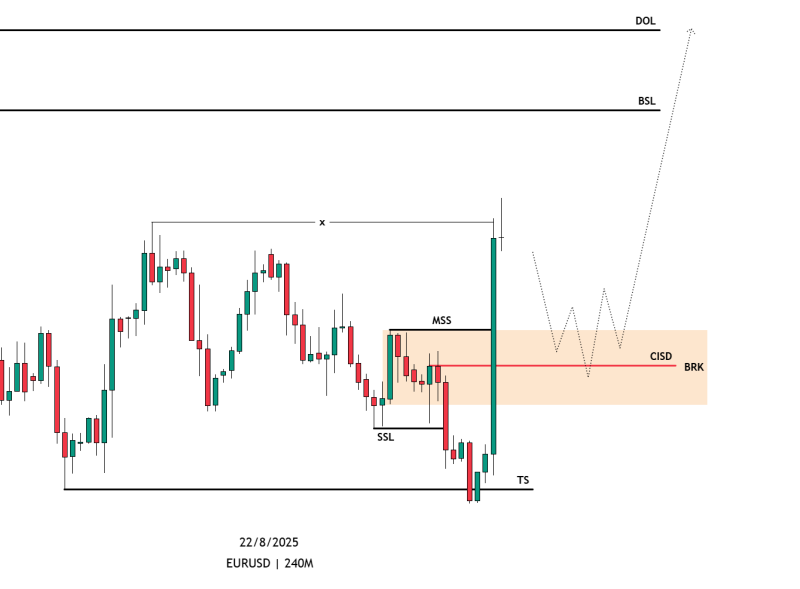

The recent price action tells a compelling story of renewed bullish momentum. Famous trader highlighted how EUR/USD executed a perfect sweep of short-term sell-side liquidity before launching into an impressive rally on the 4-hour timeframe. This wasn't just any ordinary bounce – it was a calculated move that demonstrated genuine buying pressure returning to the market.

The breakout sequence unfolded exactly as technical analysts would expect from a healthy trend reversal. Price first cleared out the weak hands by dipping into liquidity zones, then surged with conviction through previous resistance levels. This type of action typically signals that institutional players are positioning for a more substantial move higher.

Critical Zones Now in Focus

With the market structure officially broken to the upside, attention shifts to the next series of technical levels that could either support the continuation or provide temporary obstacles. The consolidation block that previously acted as resistance may now serve as a critical support zone on any potential pullbacks.

The beauty of this setup lies in its clarity – bulls have drawn a line in the sand, and the market's response to key levels will determine whether this breakout has genuine staying power or represents another false dawn for EUR/USD bulls.

Usman Salis

Usman Salis

Usman Salis

Usman Salis