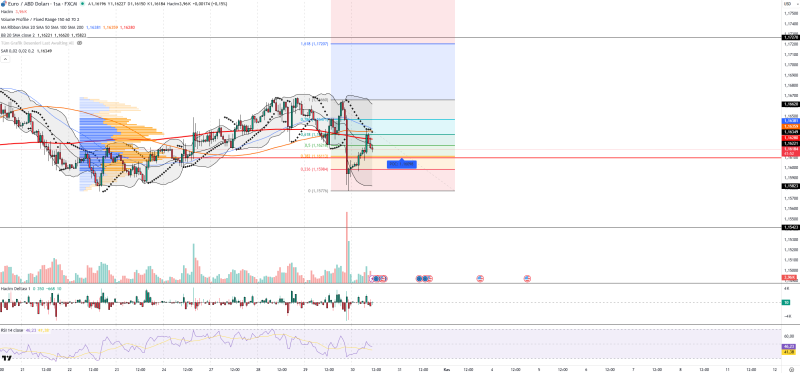

The euro continues facing headwinds against the dollar as technical signals point to a shaky recovery. The pair is consolidating around 1.1620, where several Fibonacci retracement levels come together. Despite bounce attempts, EUR/USD stays pressured by a firmer dollar and widening policy differences between the Federal Reserve and European Central Bank.

EUR/USD Technical Picture: Neutral Bias Under Pressure

According to Forex Sinyal Merkezi trader analysis, the pair is stabilizing between 1.1618–1.1620 after pulling back from higher ground. This zone matches up with Fibonacci 0.382 (1.1613) and 0.5 (1.1621) retracement levels, creating a critical area for near-term direction.

If the pair manages hourly closes above this range, a short-term bounce toward 1.1638–1.1660 could play out. But repeated failures here would likely confirm the bearish tone. On the flip side, a drop below 1.1598 (Fibo 0.236) might spark fresh selling pressure toward 1.1582 and possibly 1.1542, both lining up with earlier consolidation zones and high-volume areas.

Indicators Reflect Weak Momentum and Rising Volatility

- Bollinger Bands are widening, pointing to higher volatility ahead

- Parabolic SAR dots sit above the candles, signaling the short-term trend stays negative

- RSI (14) at 46.23 lingers in neutral-to-weak territory, showing limited buying interest

- Volume Delta is slightly positive but not strong enough to suggest real demand

- Volume Profile (POC) centers near 1.1609, where most recent trading happened—staying below this keeps the bias tilted downward

- A noticeable volume spike on recent red candles hints at stronger short-side participation

Fundamental Drivers: Policy Gap Favors the Dollar

The dollar holds firm as markets bet the Fed will slow or pause rate cuts. This expectation, along with wider U.S.–Eurozone yield spreads, keeps supporting the greenback. Meanwhile, the ECB has its hands tied—inflation above target limits room for easier policy, adding consistent pressure on the euro. That said, if risk sentiment improves through something like a stock market rally or softer U.S. inflation data, the euro might catch temporary relief and ease some selling pressure.

Key Levels to Watch

Support: 1.1598 • 1.1582 • 1.1542

Resistance: 1.1621 • 1.1638 • 1.1660

As long as EUR/USD trades below 1.1621, bears stay in charge. A solid push above that level would mark the first real sign of stabilization and could open the door to testing 1.1638–1.1660.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir