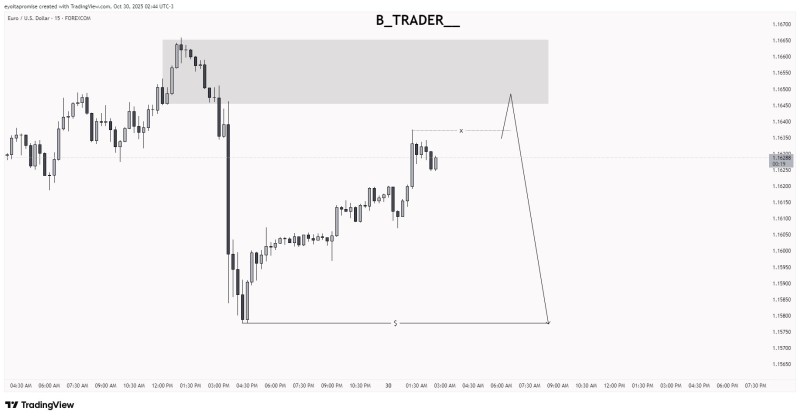

Following last week's sharp pullback, EUR/USD has rebounded but now appears to be running out of steam. Market participants are eyeing a possible reversal as price action nears a critical resistance area. The current technical structure favors a short-term sell scenario, suggesting bearish forces may soon reassert control if the pattern plays out as expected.

EUR/USD Technical Setup

B Trader's analysis of the 15-minute timeframe shows the pair staged a solid recovery before hitting a wall beneath the 1.1650–1.1670 zone—a former support area that has now flipped into resistance. This shaded region on the chart marks where sellers previously stepped in aggressively, triggering a steep drop.

Right now, EUR/USD is hovering just under 1.1630, with the chart suggesting a potential retest of resistance before the downtrend resumes. This move would align with what traders call a liquidity sweep—a brief push higher to catch buy stops before a more decisive sell-off takes hold.

Here's what the chart is telling us: resistance sits at 1.1650–1.1670 in that supply zone, support targets are down around 1.1580–1.1560, and current price is trading near 1.1628. The setup hints at a possible bounce toward 1.1640, followed by selling pressure that could push the pair back down toward 1.1580.

Macro Factors Supporting the Downside

The technical picture lines up with what we're seeing in the broader market. The dollar continues to find support from elevated Treasury yields and hawkish Fed rhetoric, both of which keep pressure on the euro. Recent eurozone data hasn't helped either—weak manufacturing numbers and cooling inflation have added fuel to the bearish case for the single currency. As traders weigh these fundamentals, EUR/USD looks likely to keep reflecting the gap between a solid U.S. economy and Europe's more fragile outlook.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah