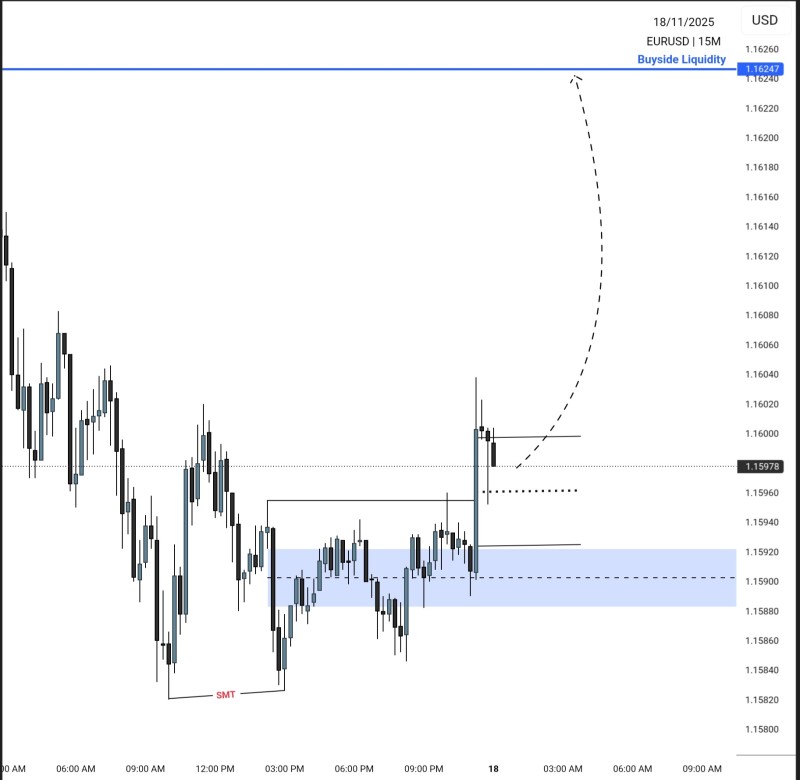

⬤ EUR/USD has begun forming a short-term bullish pattern on the 15-minute chart following a bounce from a well-defined demand zone. The pair is showing early upward momentum after sweeping intraday lows, now trading around 1.1597 and holding above a previously broken resistance level. This price action suggests buyers are starting to take control in the near term.

⬤ The demand zone sits between 1.1580 and 1.1590, serving as the launchpad for the recent move higher. After dipping into this area, EUR/USD pushed up with a strong candle and reclaimed short-term structure. Price is now consolidating just above this zone, which hints at potential continuation. The projected path shows a gradual climb toward the 1.1600–1.1610 range, aligning with the developing order-flow bias.

⬤ The next key target is the buyside liquidity level near 1.1624. This zone represents a cluster of resting buy-side orders and previous highs, making it a natural target if EUR/USD keeps its bullish momentum. The chart shows a potential acceleration toward this liquidity pocket, reflecting the current constructive market structure and the strength of the rebound from demand.

⬤ This move matters because EUR/USD has been stuck in a tight intraday range, and a push toward the next liquidity level would signal a clearer directional shift. A continuation toward 1.1624 would show building momentum and could influence broader short-term sentiment across major currency pairs. The bounce from demand and the improving structure provide the technical setup for this bullish scenario.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah